Summary of Taxation Measures-Budget 2006

TAXATION MEASURES

INCOME TAX CHANGES

Personal Tax Package

The main elements, including associated costsa, of the personal tax package, which take effect from 1 January 2006, are as follows:

Changes to Income Tax |

Full Year Cost €m |

||

Employee Tax Credit increased increased by €220 to €1,490 |

285 |

||

Personal Credits increased by €50single /€100 married to €1,630 single/€3,260 married |

96 |

||

New Standard Rate Bands from 1 january 2006 |

|||

Current |

Proposed |

||

Single |

€29,400 |

€32,000 |

456 |

Married One Income |

€38,400 |

€41,000 |

|

Married Two Incomesb |

€58,800 |

€64,000 |

|

Lone Parent/Widowed Parent |

€33,400 |

€36,000 |

|

Age Exemption Limits (single/married) |

6 |

||

increased from €16,500/€33,000 to €17,000/€34 |

|||

Other Credits from 1 January 2006: |

|||

Current |

Proposed |

||

Widowed person |

€400 |

€500 |

|

Widowed parent: |

|||

Year 1 |

€2,800 |

€3,100 |

|

Year 2 |

€2,300 |

€2,600 |

|

Year 3 |

€1,800 |

€2,100 |

12 |

Year 4 |

€1,300 |

€1,600 |

|

Year 5 |

€800 |

€1,100 |

|

Blind Persons: |

|||

Single |

€1,000/ |

€1,500/ |

|

Married (both blind) |

€2,000 |

€3,000 |

|

Incapacitated Child |

€1,000 |

€1,500 |

|

Dependent Relative |

€60 |

€80 |

|

Age credit: |

|||

Single |

€205 |

€250 |

|

Married |

€410 |

€500 |

|

Health Levy threshold increased from €400 per week to €440 Per week |

32c |

||

Total |

887 |

||

Further details of the main income tax elements of the package are set out in Annex A |

|||

a Costs rounded to the nearest €1 million in each case as appropriate.

b With a maximum transferability between spouses of €38,400 in 2005 and €41,000 in 2006.

c This cost will be reflected in reduction in appropriations-in-aid in the Health and Children Vote.

OTHER INCOME TAX

Allowance for Rent Paid by Certain Tenants

The maximum level of rent paid for private rented accommodation on which tax relief can be claimed, at the standard rate of tax, is being increased for those aged under 55 years of age, from €1,500 to €1,650 per annum for a single person and from €3,000 to €3,300 per annum for widowed and married persons. This equates to a tax credit of €330 per annum for single persons and €660 for widowed and married persons. For those aged 55 years and over, the maximum level of rent paid on which tax relief can be claimed is being increased from €3,000 to €3,300 per annum for a single person and from €6,000 to €6,600 per annum for widowed and married persons. This equates to a tax credit of €660 per annum for a single person and €1,320 per annum for widowed and married persons.

This measure is estimated to cost €2.2 million in 2006 and €3 million in a full year.

Tax Relief on Trade Union Subscriptions

The standard-rated tax allowance in respect of subscriptions paid by members of trade unions is to be increased from €200 to €300 per annum. This is equivalent to a tax credit of €60 per annum.

The cost of this measure is estimated to be €4.7 million in 2006 and €6.5 million in a full year.

Employment of a Carer

A tax allowance can be claimed at an individual's marginal tax rate for the cost of employing a person to care for a family member who is incapacitated. The ceiling on the amount that can be claimed under this relief is being increased from €30,000 to €50,000 per annum.

The cost of this measure is estimated to be about €0.1 million in 2006 and €0.1 million in a full year.

Tax relief for the donation of heritage property to the Proposed Heritage Trust

A new tax relief is being introduced for the donation of heritage property to the proposed Heritage Trust which is to be established shortly. The scheme will provide for up to 100% of the total market value of the heritage properties donated to the Trust to be offset against the tax liabilities of the donor. There will be a ceiling on the aggregate value of property qualifying for the scheme in any one year of €6m. Full details of the scheme and its commencement date will be set out in the Finance Bill.

The cost of this measure is €6 million per year.

Childminding relief

A new childminding relief is being introduced. Where an individual minds up to three children in the minder's own home, no tax will be payable on the childminding earnings received, provided the amount is less than €10,000 per annum. Following the “Rent-a-Room” scheme model, if childminding income exceeds this, the total amount will be taxable, as normal, under self-assessment. An individual will be obliged to return their childminding income in their annual tax return and also to notify their County Childcare Committee that they are providing a childminding service. Full details of the scheme will be set out in the Finance Bill.

The cost of this measure is estimated to be €3 million in 2006 and €4 million in a full year.

Tax Relief to Individuals for Interest on Loans taken out to acquire shares in, or to lend to, Property Rental Income Companies

Tax relief currently available to individuals for interest on loans taken out to acquire an interest in property rental income companies is being abolished for all new loans taken out after 7 December 2005. However, tax relief will continue to be available to individuals for interest on existing loans taken out to acquire an interest in such companies and on new loans taken out in relation to trading companies.

The yield from this measure is estimated at €5 million in a full year.

Tax relief on Donations to Approved Bodies

The scheme of tax relief on donations to approved bodies which has up to now provided tax relief on qualifying donations in the form of money only is being extended to include the donation of publicly quoted securities. Where income tax relief is given in relation to such donations, no other relief will be available.

Full details of this measure will be contained in the Finance Bill.

Change from Monthly to Quarterly Filing for PAYE Forms P30

From 1 April 2006 employers whose annual PAYE and PRSI payments do not exceed €30,000 will be able to return their PAYE and PRSI on a quarterly basis, rather than monthly as at present. The first quarterly return will be due on 14 July 2006.

There is a once off cash flow loss to the Exchequer of €102 million in 2006.

Remittance Basis of Taxation

The remittance basis of income taxation applies at present to individuals resident here who are either not domiciled or not ordinarily resident in the State and it provides that such individuals are liable to Irish income tax only on that portion of their income arising outside the State or the UK that is remitted here.

The remittance basis of taxation will now be discontinued in respect of employment income in so far as the employment is exercised in the State. This will take effect from 1 January 2006.

The yield from this measure is estimated at over €50 million in 2006, €75 million in 2007 and €100 million in subsequent full years.

ANTI-AVOIDANCE MEASURE

Capital Gains Tax

The deferral of capital gains tax on a disposal of a chargeable asset to a spouse, a separated spouse or a former spouse (i.e. following a divorce) will not apply to disposals on or after 7 December 2005 where the spouse acquiring the asset would not be liable to Irish capital gains tax if he/she disposed of that asset in the year in which he/she acquired it. This is to ensure that Irish capital gains tax is not avoided by such an individual disposing of the asset abroad while being non tax resident in the State.

It is not possible to estimate the precise yield from this measure

PENSIONS

Tax relief for pensions

The maximum allowable pension fund on retirement for tax purposes will be €5 million or, if higher, the value of the fund on 7 December 2005. Both sums will be adjusted annually from the tax year 2007 in line with an earnings index. The relevant maximum will apply to the aggregate value of all pension provision held by an individual. Where a fund exceeds the relevant limit, the excess in the pension fund will be liable to a once-off income tax charge at the 42% rate when it is drawn down, so as to recover the excess tax relief granted.

Tax exemption for pension lump sums

At present, various restrictions apply to the size of a pension lump sum which may be taken tax free. In certain circumstances up to 25% of a pension fund may be taken as a lump sum. Where existing lower limits do not apply, the maximum tax free lump sum for drawdowns made on or after 7 December 2005 will be €1.25 million, being 25% of the new maximum fund amount of €5 million. The balance of a lump sum greater than this amount will be taxed at the marginal rate as income. The restriction applies to a single lump sum or, where more than one lump sum is drawn down, the aggregate value of those lump sums.

Approved Retirement Funds (ARFs)

An annual 3% imputed distribution will apply to the value of assets in an ARF at 31 December each year and will be taxable. This will be phased in over three years from 2007, at 1% in 2007, 2% in 2008 and 3% from 2009 onwards. Any actual distributions from the ARF during the year will be deducted from the imputed distribution for that year and any net amount will be taxed at the individual's marginal income tax rate. The charge will apply to ARFs created on or after 6 April 2000. This imputed distribution will not apply in the case of Approved Minimum Retirement Funds.

The annual saving to the Exchequer from these three measures is estimated at €12 million in 2006 and €42 million in a full year.

Contribution limit

The current annual earnings limit of €254,000 for contributions to personal pensions, and PRSAs and for employee contributions to occupational pensions will also be adjusted annually from the tax year 2007 in line with an earnings index.

This indexation will involve a cost to the Exchequer in excess of €6m in a full year.

Further details of these pension measures will be contained in the Finance Bill.

FARMER TAXATION

Extension of the Young Trained Farmer Stamp Duty Relief for a Further Three Years

The Finance Act 2003 provided for full exemption from stamp duty on the transfer of land to a young trained farmer for a three year period until 31 December 2005. This exemption will be extended for a further three year period to 31 December 2008 and will be provided for in the Finance Bill 2006.

The cost of extending this measure is estimated at €19 million in 2006 and in a full year.

EU Single Farm Payment Entitlement and Capital Acquisitions Tax Agricultural Relief

The EU Single Farm Payment Entitlement will be recognised as a qualifying agricultural asset for the purposes of the Capital Acquisitions Tax Agricultural Relief qualification test in relation to gifts or inheritances. This measure will be included in the Finance Bill 2006.

The cost of this measure is unlikely to be significant.

EU Single Farm Payment Entitlement and Capital Gains Tax Retirement Relief

The EU Single Farm Payment Entitlement will qualify as an asset for the purpose of Capital Gains Tax Retirement Relief provided the farmer in question fulfils the 10 year rule in relation to ownership and usage of the land which will be disposed of at the same time as that Entitlement. This measure will be included in the Finance Bill 2006.

The cost of this measure is unlikely to be significant.

EU Single Farm Payment Entitlement and Young Trained Farmer Stamp Duty Relief

The stamp duty relief for Young Trained Farmers will be expanded to apply also to the transfer of the new EU Single Farm Payment Entitlement to young trained farmers. This additional relief will only apply to the transfer of an Entitlement where the land associated with that Entitlement is also being transferred. This measure will be included in the Finance Bill 2006.

The cost of this measure is estimated to be approximately €2 million in 2006 and in a full year.

Farm Pollution Control Relief

The annual cap on the amount that can be claimed under the flexible writing down arrangement for the special tax relief scheme for expenditure on farm pollution control measures is to be increased to the lesser of €50,000 or 50 per cent of qualifying expenditure with effect from 1 January 2006.

The cost of this measure is estimated to be about €0.5 million in 2006 and €1 million in a full year.

Leased Land Exemption

The exemption for income derived from certain leases of farmland is being increased from 1 January 2006 from €7,500 to €12,000 per annum for leases of between five and seven years and from €10,000 to €15,000 per annum for leases of seven or more years.

The cost of this measure is estimated to be about €1 million in 2006 and €2 million in a full year.

EXCISES

Reduction in Excise Duty for Home Heating Oils (Kerosene and LPG)

The Excise Duty on Kerosene used for heating is being reduced from €31.74 to €16.00 per 1,000 litres with effect from midnight on 7 December 2005. The Excise Duty on Liquid Petroleum Gas used for heating is being reduced from €20.86 to €10.00 per 1,000 litres from the same date. These rates will be reduced to zero in Budget 2007.

The cost of this measure is estimated to be €1.5 million in 2005, €24 million in 2006 and €46 million in 2007.

Reduction in Betting Duty from 2% to 1%

The Betting Duty rate of 2% will be reduced to 1% with effect from 1 July 2006 with the duty to be borne by the industry. This will be provided for in the Finance Bill. The potential for widening the tax base on which this 1% will apply will be examined.

The cost of this measure is estimated to be €12.5 million in 2006 and €25 million in a full year.

Excise Relief for Biofuels

In order to achieve an initial target of 2% of the fuel market to be taken up by biofuels by 2008, a five-year scheme of targeted excise relief will commence in 2006. The framework of this scheme will be contained in the Finance Bill.

The cost of this measure is estimated to be €20 million in 2006, €35 million in 2007 and €50 million in 2008, 2009 and 2010.

Introduction of a Vehicle Registration Tax Relief for Flexible Fuel Vehicles

A VRT relief of 50% for new flexible fuel vehicles – vehicles capable of operating on high-grade biofuels – is being introduced for a two year period, with effect from 1 January 2006. Further details will be provided in the Finance Bill.

The cost of this measure is estimated to be €1 million in 2006 and €1 million in 2007.

VAT

VAT Registration Thresholds

The VAT registration thresholds for small businesses are being increased from €25,500 to €27,500 in the case of services and from €51,000 to €55,000 in the case of goods. These increases will be introduced in the Finance Bill and will take effect from 1 May 2006. This will reduce the administrative burden for both small businesses and the Revenue Commissioners.

The cost of this measure is estimated to be €6 million in 2006 and €12 million a full year and remove 2,200 businesses from the VAT net.

STAMP DUTY

Companies Capital Duty (CCD)

The Finance Bill 2006 will provide for the abolition of companies capital duty. This 0.5% duty that is charged on the issuing of share capital is being abolished for transactions effected on or after 7 December 2005.

The cost of this measure is estimated at €16m in a full year.

CORPORATION TAX

Section 247 Relief-Restriction of Interest Relief in certain group company circumstances

Measures will be introduced to restrict the use of the interest relief provisions of Section 247 of the TCA 1997 in the context of transactions between related companies, where the principal purpose of the transactions is apparently to generate, in an artificial manner, interest charges qualifying for relief under Section 247.

The proposed restriction will apply to structures whereby indebtedness is created, effectively between companies in a group, in connection with the transfer of share ownership from one company to another company in that group.

It is intended therefore to bring forward legislation in the Finance Bill 2006, to prevent these kinds of artificial structures availing of the interest relief provisions of Section 247. If further similar arrangements emerge, additional measures will be introduced.

Any measures introduced will be carefully targeted so as to minimise the possible impact, if any, on legitimate commercial use of Section 247, or any other area of the tax code introduced to facilitate bona-fide transactions between companies. The measures will affect transactions effected on or after 7 December 2005.

LEASING INCOME RELIEF

Changes to the tax treatment of losses in the leasing of long-life assets

The Finance Bill 2006 will contain measures to alleviate certain restrictions on the offset by companies of losses arising from capital allowances on the leasing of long-life plant or machinery. While this will be of benefit to business, it is not intended to remove the overall restrictions on the use of capital allowances, thereby safeguarding the Exchequer position.

Under existing law, losses incurred from leasing plant or machinery may only be offset against income from similar leasing activities. The scope of income against which these losses can be offset will be extended to include income from certain activities that are ancillary to the trade of leasing.

A further restriction applies to certain leases of plant or machinery that do not have an even flow of lease payments over the primary period of the lease. Losses arising on such a lease may only be offset against income from that lease. It is proposed to adjust this restriction by allowing losses on the lease of long-life plant or machinery to be offset against income from similar leasing activities.

Finally, in the case of a lease that is denominated in a foreign currency it will be permitted to determine whether the lease has an even flow of lease payments by reference to the payment schedule in that currency without having to convert those payments into euro.

CAPITAL ALLOWANCES AND TAX INCENTIVE SCHEMES

Capital Allowances (and Expenses) for Business Cars

The car value threshold for business cars is being increased from €22,000 to €23,000. The new threshold will apply to capital allowances and leasing charges for new and second-hand cars used in the course of a trade, profession or employment.

In the case of corporation tax, the new threshold will apply for expenditure incurred in an accounting period ending on or after 1 January 2006. In the case of income tax, the new threshold will apply for expenditure incurred in the basis period for the tax year 2006 and subsequent tax years.

These measures will cost €1.5m in 2006 and €3m in a full year.

Capital Allowances for Private Hospitals – extension of list of qualifying services

At present in order to qualify as a private hospital eligible for capital allowances, the hospital must, inter alia, provide five specialist services from a list of fourteen potential services ranging from oncology to paediatric services. This list will be will be augmented to include psychiatric care services.

Capital Allowances for Private Psychiatric Hospitals

In addition, the current scheme of capital allowances for private hospitals will be extended to provide for capital allowances for the construction or refurbishment of buildings used as private psychiatric hospitals. While the hospital will provide services to private patients, 20 per cent of the bed capacity must be available for public patients, and the hospital must provide a discount of at least 10 per cent to the State in respect of the fees to be charged in respect of the treatment of these patients.

The scheme is subject to clearance by the European Commission from an EU State Aids perspective.

The cost of this measure is estimated at €2m in 2007 and €2m in a full year.

Full details will be announced in the Finance Bill 2006.

Termination of Certain Tax Reliefs and Transitional Measures

The following property-based tax incentive schemes are to be discontinued: the Urban Renewal Scheme, Rural Renewal Scheme, Town Renewal Scheme, and the special reliefs for hotels, holiday cottages, student accommodation, multi-storey car parks, third-level educational buildings, sports injury clinics, developments associated with park-and-ride facilities, and the general rental refurbishment scheme.

Transitional arrangements will apply as follows: full relief will be available for qualifying expenditure up to end-December 2006; 75% of the normal relief will apply for qualifying expenditure in the period January to end-December 2007; 50% of the normal relief will apply for qualifying expenditure in the period January to end-July 2008; and no relief under the schemes will apply for expenditure after that date.

The transitional measures will apply only to “pipeline” projects which will have to have incurred at least 15% of qualifying construction costs (not including site costs) by end-December 2006; this condition will not apply to the general rental refurbishment scheme.

Other existing scheme conditions must also be complied with: this means that, in the case of the Urban Renewal Scheme and the relief for multi-storey car parks, 15% of total project expenditure must have been incurred by a certain date (30 June 2003 and 30 September 2003 respectively); in the case of the relief for third-level buildings, a Ministerial certificate must have been applied for by end-December 2004; in the case of all of the other schemes (apart from the relief for sports injury clinics and the general rental refurbishment scheme), full planning permission must have been applied for before end-December 2004.

The detailed provisions, which will need to be discussed in advance with the European Commission in the case of the non-residential reliefs, will be contained in the 2006 Finance Bill.

The termination of tax schemes will yield full-year tax savings of several hundred million euro p.a. The full benefit will not arise until after 2012 when the bulk of existing capital allowances have been fully claimed in tax returns. The transitional measures being put in place now will entail a cashflow saving estimated at €12 million in 2006 and €34 million in 2007, with a cost of €17 million on average in the period 2008 to 2014. These estimates are sensitive to assumptions made regarding the take-up of reliefs and are therefore tentative.

Tax relief for Park-and-Ride Facilities and the Living-Over-the-Shop Scheme – New Provisions

Both the relief for investment in park-and-ride facilities and the Living-Over-the-Shop scheme are closed to new projects since end-December 2004. These schemes will be reintroduced in a more focused way; but the relief for commercial and residential developments associated with park-and-ride facilities will not be reintroduced. “Pipeline” projects under the outgoing provisions will be eligible for the same transitional measures as the Rural Renewal and Town Renewal schemes (see above). Full details will be set out in the 2006 Finance Bill.

The cost of this measure is estimated to be less than €1 million in 2006 and approximately €7 million in a full year.

Tax Relief for Investment in Childcare Facilities, Private Hospitals and Private Nursing Homes

The tax reliefs for investment in childcare facilities, private hospitals and private nursing homes are to be continued, subject to the consideration of additional investment options. Detailed provisions will be set out in the 2006 Finance Bill.

These measures will entail a cash-flow cost estimated at around €3 million in 2006 and €8 million in 2007, with savings of around €10 million p.a. arising in future years.

Exemption of Stallion and Greyhound Stud Fees

The exemption from tax of stallion and greyhound stud fees will end as of 31 July 2008, which is the same termination date as that for various property tax incentives. In the meantime new taxation arrangements will be introduced for the stallion and greyhound stud industries and these will be subject to discussions in due course with the EU Commission.

There will be no gain to the Exchequer from this measure in 2006 and 2007. There will be some gain in 2008 which it is not possible to quantify at this stage.

PRSI CHANGES

Employee PRSI annual ceiling

As from 1 January 2006, the employee PRSI contribution ceiling will increase from €44,180 to €46,600.

This is in accordance with the assumption made for PRSI income as set out in the 2006 Estimates for the Public Services.

Employee PRSI weekly threshold

As from 1 January 2006, the employee weekly threshold for liability to PRSI will increase from €287 to €300.

This will cost €8 million dollars and €8.7 million in a full year

RESTRICTION OF RELIEFS

Restriction on the use of Tax Reliefs by High Income Taxpayers

The new measure is being introduced with effect from 1 January 2007 and will limit the use of tax breaks by those with high incomes. It is based on restricting the amount of specified reliefs which a person can use to reduce their tax bill in any one year to 50% of the person's income.

How it will work

The measure will work on the following lines:

- The taxpayer will add up the total amount ofspecified reliefsbeing claimed (these will be listed in the Finance Bill and will include the property based incentive reliefs in general and various other reliefs, including exemption of artistic income, but will exclude the normal items claimed by taxpayers such as medical expenses, trade union subscriptions, exemptions such as that for child benefit, as well as the normal business expenses and deductions for capital allowances on plant and machinery, losses etc);

- The specified reliefs will be added back to the taxpayer's taxable income to give a “recomputed gross income” figure;

- Where the recomputed gross income is greater than a high income threshold of €250,000, then the aggregate deduction for specified reliefs in the year will be restricted to 50% of recomputed gross income;

- The new taxable income figure will be taxed at the ordinary income tax rates; since the top rate of 42% will generally apply, an effective rate of close to 20% will be achieved;

- The system will contain a taper to avoid a sudden jump in tax at the threshold. This is a normal feature of tax systems. The taper is demonstrated in Appendix 1;

- Finally, any relief denied in a particular year will be carried forward to the following year (or years).

For example, where an individual has taxable income, i.e. income after reliefs, of €100,000 and specified reliefs of €500,000 in 2007, the aggregate of reliefs (€500,000) to be allowed will be restricted to half of the recomputed gross income – which will be €300,000, i.e. (€100,000 + €500,000) × 50%. The allowances of €200,000 disallowed in 2007 may be carried forward to 2008. The effect of the restriction will be to increase the amount of the individual's taxable income to €300,000, (i.e. €100,000 + €200,000) and consequently to increase the amount of tax payable.

The €200,000 reliefs not allowed in 2007 will be carried forward for deduction in 2008 – subject, again, to not less than half the gross income of that year being in charge.

A further example showing how the system will 2007. apply is set out in Appendix 2. Other examples will be made available on the Department of Finance's website www.finance.gov.ie

Full details of the measure will be provided in the Finance Bill 2006. It will take effect from 1 January

It is estimated that the measure will yield €5 million in 2007 and €50 million in a full year.

Appendix 1

Table 1. Percentage restriction of reliefs over €250,000 to €500,000 income band

This table is intended to explain how the tapering arrangement will work to restrict the reliefs of a person who had sufficient reliefs to eliminate all of his/her income for taxation purposes under the current system.

Recomputed gross income |

Example value of specified reliefsa |

Taxable Without restriction (current system) |

Restricted reliefs with taper(restricted to greater of €250k or 50% of recomputed income) |

% of reliefs allowed |

Taxable income after restriction of reliefs with taperb |

249,000 |

249,000 |

Nil |

249,000 |

100% |

Nil |

250,000 |

250,000 |

Nil |

250,000 |

100% |

Nil |

251,000 |

251,000 |

Nil |

250,000 |

99% |

1,000 |

252,000 |

252,000 |

Nil |

250,000 |

99% |

2,000 |

255,000 |

255,000 |

Nil |

250,000 |

98% |

5,000 |

260,000 |

260,000 |

Nil |

250,000 |

96% |

10,000 |

265,000 |

265,000 |

Nil |

250,000 |

94% |

15,000 |

270,000 |

270,000 |

Nil |

250,000 |

93% |

20,000 |

275,000 |

275,000 |

Nil |

250,000 |

91% |

25,000 |

280,000 |

280,000 |

Nil |

250,000 |

89% |

30,000 |

290,000 |

290,000 |

Nil |

250,000 |

86% |

40,000 |

300,000 |

300,000 |

Nil |

250,000 |

83% |

50,000 |

325,000 |

325,000 |

Nil |

250,000 |

77% |

75,000 |

350,000 |

350,000 |

Nil |

250,000 |

71% |

100,000 |

375,000 |

375,000 |

Nil |

250,000 |

67% |

125,000 |

400,000 |

400,000 |

Nil |

250,000 |

63% |

150,000 |

425,000 |

425,000 |

Nil |

250,000 |

59% |

175,000 |

450,000 |

450,000 |

Nil |

250,000 |

56% |

200,000 |

460,000 |

460,000 |

Nil |

250,000 |

54% |

210,000 |

470,000 |

470,000 |

Nil |

250,000 |

53% |

220,000 |

480,000 |

480,000 |

Nil |

250,000 |

52% |

230,000 |

490,000 |

490,000 |

Nil |

250,000 |

51% |

240,000 |

500,000 |

500,000 |

Nil |

250,000 |

50% |

250,000 |

501,000 |

501,000 |

Nil |

250,500 |

50% |

250,500 |

510,000 |

510,000 |

Nil |

255,000 |

50% |

255,000 |

525,000 |

525,000 |

Nil |

262,500 |

50% |

262,500 |

550,000 |

550,000 |

Nil |

275,000 |

50% |

275,000 |

a Assumes all reliefs are “specified” reliefs. In practice this is unlikely to apply.

b Where restriction applies, i.e. recomputed income is greater than €250,000, the tapering rule mitigates the effect of the restriction by allowing specified reliefs to be deducted up to the greater of either €250,000 or 50% of recomputed income. This means that the restriction gradually increases to a 50% restriction over recomputed income from €250,001 to €500,000.

Appendix 2

Example 1: Individual Subject to Full Restriction

Mr. A, a single man, owns a property portfolio from which he receives €797,150 in 2006 in rents (net of expenses). His entitlement to property incentive reliefs for the year is €700,000.

He also invests €31,750 each in BES and Film relief (film relief is restricted to 80% of €31,750 i.e. €25,400).

In addition, Mr. A is in receipt of dividends of €160,000.

Example 1: Position for 2007 if no restriction |

€ |

Rents (net of expenses |

797,150 |

Less property incentive reliefs |

(700,000) |

Taxable rents |

97,150 |

Dividends |

160,000 |

Total income |

257,150 |

Less other tax deductions |

(57,150) |

Taxable income |

200,000 |

Tax: |

|

• 32,000 @ 20% |

6,400 |

• 168,000 @ 42% |

70,560 |

76,960 |

|

Less personal tax credit |

(1,630) |

Final Tax |

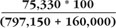

75,330 |

Effective rate of tax: |

7.87% |

Example 1: Position for 2007 applying new restriction |

€ |

Original taxable income |

200,000 |

Add specified reliefs |

757,150 |

Recomputed gross income |

957,150 |

Deductible reliefs restricted to greater of 50% of €957,150 or €250,000 |

478,575 |

Original Taxable income |

200,000 |

Add Restriction of deductible reliefs (€757,150 less €478,575) |

278,575 |

Revised taxable income |

478,575 |

Tax: |

|

• 32,000 @ 20% |

6,400 |

• 446,575 @ 42% |

187,561 |

Less personal tax credit |

193,961 |

(1,630) |

|

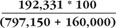

Final tax |

192,331 |

Effective rate of tax: |

20.09% |