R (on the application of Federation of Technological Industries & Ors) v C & E Commrs (Case C–384/04)

The European Court of Justice (ECJ) ruled that art. 21(3) of Directive 77/388 (‘the sixth directive’) allowed a member state to enact legislation which provided that a taxable person, to whom a supply of goods or services had been made and who knew, or had reasonable grounds to suspect, that some or all of the VAT payable in respect of that supply, or of any previous or subsequent supply, would go unpaid, might be made jointly and severally liable, with the person who was liable, for payment of that VAT. Such legislation had to comply with the principles of legal certainty and proportionality. However, the imposition of joint and several liability to pay VAT could not be based on art. 22(8); nor did that provision permit member states to require a person, who was neither liable for payment of VAT nor jointly and severally liable to pay it, under art. 21, to provide security for the payment of VAT due from a third party.

Facts

Fifty-three traders in mobile telephones and computer processing units and their trade body the Federation of Technological Industries (‘the claimants’) applied to the court for permission to claim declarations that para. 4(1A) and (2) of Sch. 11 to and s. 77A of VATA 1994 (inserted by FA 2003, s. 17 and 18) were contrary to Community law and were incompatible with the European Convention on Human Rights, and a reference of that question to the ECJ.

The provisions in question were passed to counter widespread abuse of the VAT system by way of so-called acquisition fraud and carousel fraud. The ‘security provision’ permitted Customs, if it thought it necessary for the protection of the revenue, to require a taxable person to provide security for the payment of VAT as a condition of supplying or being supplied with goods. The ‘joint and several liability provision’ gave Customs power to impose joint and several liability on a person for unpaid VAT of another trader where the taxable person knew or had reasonable grounds to suspect that VAT would be unpaid. Customs argued that power to enact such provisions was expressly conferred by art. 21(3) and art. 22(8) of the sixth directive.

The judge held that the taxpayer's argument that art. 21(3) of the sixth directive did not permit member states to make persons, other than those specified, jointly and severally liable for the payment of tax, was likely to succeed. He accordingly gave permission to apply for judicial review on that issue and referred to the ECJ the question of whether the impugned provisions of VATA 1994 were authorised by the terms of the sixth directive. Customs appealed arguing that it was clear that as a matter of Community law the relevant provisions of domestic law were authorised by the directive and that the judge's decision should be reversed.

The Court of Appeal dismissed Customs’ appeal. It was common ground that the question before the court turned solely on whether art. 21(3) of the sixth directive conferred a general power to enact laws creating joint and several liability subject only to the general principles of Community law, or whether the class of person who could be made so liable was limited. The correct application of Community law in this case was not so obvious as to leave no scope for any reasonable doubts. This was clearly an EU-wide problem since many other states had enacted similar legislation and it was therefore appropriate to make a reference to the ECJ of the issues whether art. 21(3) and 22(8) of the sixth directive authorised the legislation at issue ([2004] BTC 5,623).

Issue

Whether art. 21(3) and 22(8) of the sixth directive authorised the legislation at issue.

Decision

The ECJ (Third Chamber) (ruling accordingly) said that a national provision, such as that established by FA 2003, s. 18, which laid down the rules on the basis of which a taxable person might be made jointly and severally liable to pay a sum in respect of VAT due from another taxpayer, related to the determination of the person who might be made liable for the payment of that VAT to the public exchequer, and not to its collection. It followed that that provision came within the scope of art. 21 of the sixth directive. Article 21(3) authorised member states, in the situations referred to in art. 21(1) and (2), to provide that a person other than the person actually liable should be made jointly and severally liable to pay the VAT.

It followed from the clear and unambiguous terms of art. 21(3) that that provision permitted, as a rule, member states to enact measures under which a person was to be jointly and severally liable to pay a sum in respect of VAT payable by another person made liable by one of the provisions of art. 21(1) and (2). Whilst it was legitimate for the measures adopted by the member state, on the basis of art. 21(3), to seek to preserve the rights of the public exchequer as effectively as possible, such measures must not go further than was necessary for that purpose.

The national rules in question provided that a taxable person other than the person who was liable could be made jointly and severally liable to pay the VAT with the latter person if, at the time of the supply to him, the former knew or had reasonable grounds to suspect that some or all of the VAT payable in respect of that supply, or of any previous or subsequent supply of those goods, would go unpaid. A person was presumed to have reasonable grounds for suspecting that such was the case if the price payable by that person was less than the lowest price that might reasonably be expected to be payable for those goods on the market, or was less than the price payable on any previous supply of those goods. That presumption was rebuttable on proof that the low price payable for the goods was attributable to circumstances unconnected with failure to pay VAT.

While art. 21(3) allowed a member state to make a person jointly and severally liable, and to rely on presumptions in that regard, such presumptions might not be formulated in such a way as to make it practically impossible or excessively difficult for the taxable person to rebut them with evidence to the contrary. Those presumptions would, de facto, bring about a system of strict liability, going beyond what was necessary to preserve the public exchequer's rights.

Traders who took every reasonable precaution to ensure that their transactions did not form part of a chain which included a transaction vitiated by VAT fraud had to be able to rely on the legality of those transactions without the risk of being made jointly and severally liable to pay the VAT due from another taxable person. It was for the national court to determine whether the national legislation complied with the general principles of Community law. Article 22(8) permitted member states to impose on persons liable for VAT, and on persons declared jointly and severally liable to pay it, determined under art. 21, obligations, other than those provided for in the preceding paragraphs of art. 22, such as that of providing security for the payment of the VAT due, which they deemed necessary for the collection of that tax and for the prevention of evasion. However, member states might, within the limits imposed by the general principles of Community law, rely on art. 21(3) to introduce joint and several liability for the payment of VAT. Consequently, persons who were, pursuant to a national measure adopted on the basis of art. 21(3), declared jointly and severally liable for the payment of VAT could be required by the member states, under art. 22(8), to provide security for the payment of the VAT due.

European Court of Justice (Third Chamber). Judgment delivered 11 May 2006.

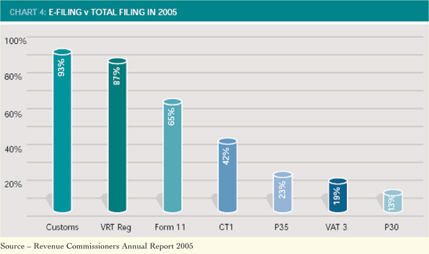

Republic of Ireland: E-Filing v Total Filing in 2005