Tax Relief on Charitable Donations

It is proposed, that with effect from 1 January 2013, the manner in which tax relief on donations is granted is to be changed. In his announcement, the Minister for Finance recognised that the proposed changes may not be beneficial to all charitable bodies. Interested parties have an opportunity to make submissions under a public consultation process. In recognition of the proposed changes, Mazars have undertaken a survey of how other tax jurisdictions grant tax relief on charitable donations.

Current Legislation

Long established tax legislation provides that where self-assessed tax payers make a qualifying donation to a charity, relief will be obtained by the donor at their marginal tax rate. Accordingly, relief is potentially available at a rate of 41%. An alternative system applies in respect of donations made by PAYE tax payers. The charity obtains the benefit of the tax relief on the qualifying donation as opposed to the donor. Where charities receive donations from PAYE donors, it is necessary for the charity to apply to the Revenue Commissioners for the underlying tax paid on the donation. The charity receives an additional payment from the Revenue Commissoners equal to the 20% or 41% underlying tax paid on the donation. The level of the payment depends on the donor's marginal rate of tax.

While donations made by self-assessed individuals are potentially relieved at the 41% tax rate, donations are classified as a specified relief under the provisions of Schedule 25B TCA 1997. Accordingly, self-assessed tax payers are within the scope of the high income earners restriction provisions. The maximum deduction which an individual can claim in the 2012 tax year is limited to the greater of €80,000 or 20% of their adjusted income.

Proposed Changes

In February 2012, the Minister for Finance announced his intention to amend the manner in which tax relief is available for donations to approved bodies in Budget 2013. It is understood that this announcement follows interaction between the Department of Finance, the Revenue Commissioners and the Irish Charities Tax Reform Group on how to simplify the relief scheme and thereby reduce the administrative burden on charities and the Revenue Commissioners in operating the scheme.

The changes which the Minister proposes on making to Section 848A TCA 1997 in Budget 2013 are:

- Donations from self-assessed and PAYE donors will be treated in the same manner. Tax relief in all cases will be repaid to the charity. The effect of this proposed change would be that self-assessed taxpayers would no longer obtain a deduction for qualifying donations at their marginal tax rate.

- A blended rate of relief will apply to all individual taxpayers, irrespective of their marginal tax rate. It is proposed that the blended rate will be set at 30%.

- An annual limit of €1 million per individual, is proposed, which can be tax relieved under the scheme.

- The high earner restriction provisions will not apply to individual self-assessed or PAYE donors.

Details of the proposed changes, as currently circulated, make no reference to amending provisions for corporate donations.

Impact of Proposed Changes

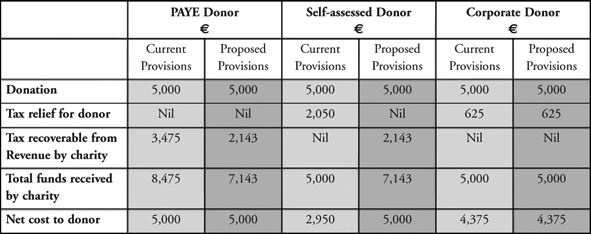

The impact of the proposed changes can be best illustrated by way of example. It has been assumed that the self-assessed donor's marginal rate of tax is 41%.

Mazars Survey

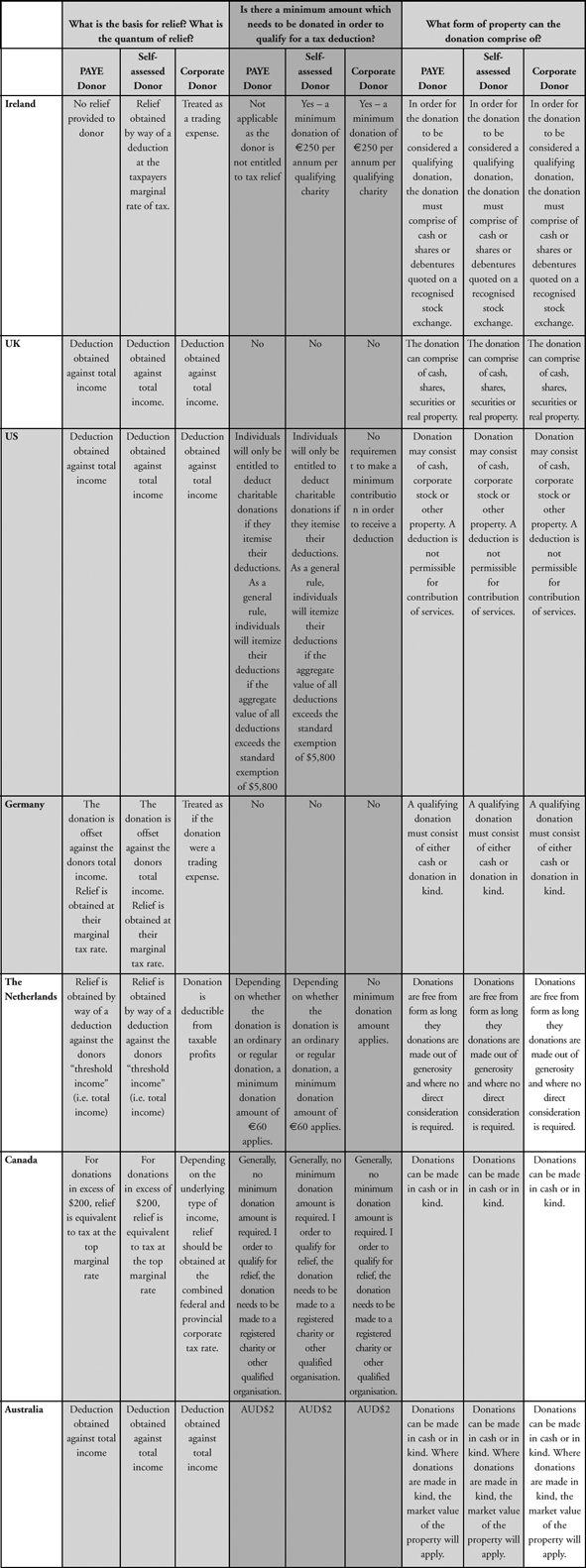

In light of the proposed changes, Mazars undertook a survey of the manner in which tax relief is granted to donors in various jurisdictions. The survey involved a review of the Irish, UK, US, German, Dutch, Canadian and Australian tax systems.

Of the countries surveyed, Ireland is the only jurisdiction which does not grant personal tax relief to employed (PAYE) donors in respect of contributions made. Self-assessed donors in each of the jurisdictions surveyed obtain tax relief for donations made. Relief is granted at the donor's marginal tax rate. If the proposed changes are enacted, Ireland will be at odds with these other jurisdictions.

Unlike our €250 minimum donation requirement, the majority of the countries surveyed do not have a minimum donation amount. Conversely, the majority of jurisdictions impose a limit on the maximum tax deductible donation. The limit typically represents a percentage of taxable income. Calculating a limit in this manner recognises the donor's financial position rather that imposing a blanket limit amount. The proposed removal of donations from the scope of the high income earner restriction is to be welcomed.

The Mazars survey was a comprehensive analysis. I have replicated below a selection of the questions and answers compiled. Of particular interest is the form of property which can be used to make a qualifying donation. Under current domestic legislation, a qualifying donation can only comprise of cash or shares or debentures quoted on a recognised stock exchange. All other jurisdictions surveyed permit a donation to include a physical asset e.g. residential property. If the legislation is to be amended, it may be an opportune time to extend the definition of qualifying donations to incorporate donations of physical assets. Such a change may be of particular benefit to charities with a focus on homelessness.

Next Step

As indicated, the proposed changes are subject to a public consultation process. Interested parties have an opportunity to make a submission to the Department of Finance. The closing date for receipt of submissions is 11 May 2012. As evident from our analysis, the proposed change to the manner of granting tax relief on donations will be different to other jurisdictions. The proposed removal of donations from the scope of the high income earners restrictions provisions is to be welcomed. If changes are to be made in Budget 2013, it would be an opportune time to extend the scope of qualifying donations to include real physical property.

Cormac Kelleher is a Corporate Tax Manager with Mazars

Email: ckelleher@mazars.ie