The R&D tax credit – recent updates

Introduction

The Research and Development (‘R&D’) tax credit is a fiscal incentive designed by the Irish Government to encourage R&D activity in the State.

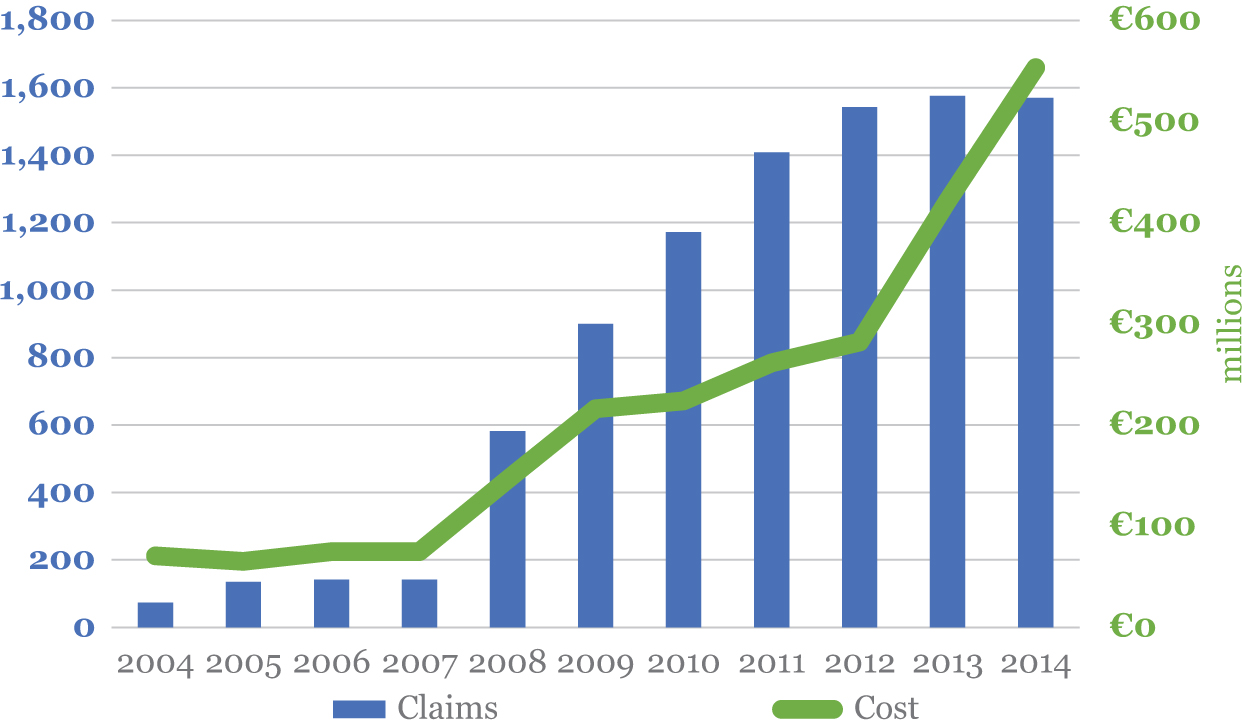

The relief provides a 25 percent refundable tax credit on the costs incurred by the company, wholly and exclusively, in the carrying on of ‘qualifying R&D activities’ by the company. The current R&D tax credit regime was first introduced in 2004 and has gone through a number of modifications since its inception. Over this time period the number of claims and the costs of the scheme have risen significantly.

For activities to qualify for the R&D tax credit, the work carried out must (amongst other things) seek to achieve an advancement of scientific or technological knowledge in an approved field of science or technology, such as pharmaceutical, computer science, life sciences, engineering, food and beverage production, to name but a few.

The incentive in numbers

Recent numbers from Government and the Revenue[1] indicate that roughly 1,500 companies claim the R&D tax credit annually, with over €554m being claimed in 2014 (Figure 1). The 2015 cost to the State is estimated to be approximately €640m[2].

Figure 1: Evolution of R&D tax credit claim numbers and costs since the establishment of the R&D tax incentive.

The most recent figures available do not provide a breakdown of the type and amounts of expenditure claimed by companies, thus it is not possible to deduct whether the ramping up of the costs for the scheme is motivated by a general increase in project expenditure or due to a number of large capital investment projects undertaken by claimant companies.

Who can claim the R&D tax credit?

Generally speaking, assessing whether a company is entitled to claim the R&D tax credit, i.e. meeting the relevant tax technical criteria, is the foundation step without which the subsequent work to assess the nature of the activities carried out and the quantum of expenditure incurred, could be meaningless. These criteria are as follows:

- The applicant must be a company and carrying on a trade.

- The company must be within the charge to Irish corporation tax.

- The company must (through its employees) undertake qualifying R&D activities within the European Economic Area (EEA).

- Revenue expenditure must be tax deductible in respect of the trade being carried on by the company. In the case of an Irish tax resident company, the expenditure must not qualify for a tax deduction or benefit under the law of another territory other than the State.

- Capital expenditure must qualify for capital allowances (i.e. Wear &Tear or Scientific Research allowances).

What projects qualify for the R&D tax credit?

The understanding of whether a project or part of a project could potentially qualify for the credit is somewhat subjective, due to the need to apply the broad and generic definition provided in the relevant legislation (i.e. the ‘Science test’) to a wide base of industry sectors. These definitions tell us that in order to qualify, the activities within a project must:

- Be systematic, investigative or experimental,

- Be within an approved field of science or technology

- Be one or more of the following:

- Basic research

- Applied research

- Experimental development

- Seek to achieve a scientific or technological advancement, and

- Involve the resolution of a scientific or technological uncertainty.

Most of the R&D effort carried on by Irish companies is in the area of experimental development (i.e. the ‘D’). According to recent surveys carried out by the Department of Finance[3], experimental development accounted for more than 71 percent of R&D expenditure in 2011 in Ireland. This is not surprising, if we consider that experimental development is the work that is directed at producing new or improving existing products or process and therefore the closest to pre-commercialization and with the most potential for return on investment.

The legislation is fairly generous, allowing also for work directed at making incremental improvements to existing products or process to qualify. The key question however, is whether the work carried out seeks to go beyond what a competent professional would recognise as being industry standard, thus seeking to achieve a technological advancement. The presence of a recognisable lack of certainty as to whether a particular goal can be achieved or the lack of certainty in relation to alternative methods that will meet desired specifications (e.g. costs, performance, etc.) is usually the starting point to understand if there is a need to advance science or technology. Of course, every company’s R&D is different and every year, prior to claiming an R&D tax credit, an assessment of the company’s activity must be made for each project on a case by case basis.

What expenditure qualifies for the credit?

To qualify for the R&D tax credit, expenditure must be incurred wholly and exclusively by the company in the carrying on by the claimant company, of qualifying R&D activity.

Qualifying expenditure may include direct salary costs of employees involved in qualifying R&D activities, materials used in the R&D process, a portion of plant and machinery (“P&M”) used in the R&D process and certain overheads (e.g. light, heat and power).

Payments to unconnected third parties who carry out qualifying R&D activity on behalf of the claimant company, such as contract R&D to private companies or universities, may also generally be included in the claim, subject to certain restrictions.

What is required to support an R&D tax credit claim?

To ensure a claim can withstand a Revenue audit, companies are required to maintain ‘contemporaneous and relevant documentation’. This means that documents should be available from the time that the R&D activity was undertaken; all entries should ideally be made on a timely and consistent basis. To be considered relevant, the contemporaneous documentation would ideally provide details of the objectives of the specific R&D activity, uncertainties, advancements sought, hypothesis, conclusions, and experiments carried out to demonstrate the systematic approach adopted, etc.

Under the self-assessment system, a company is not required to provide detailed evidence when claiming the credit. However, Revenue has a timeframe of four years (after the relevant accounting period in which the claim has been submitted) to audit/enquire into the company’s entitlement to the credit.

There is no prescribed and definitive list of supporting documentation for an R&D tax credit claim to be ‘compliant’; however, consider the following as examples of evidence that could ideally be retained in a dedicated R&D documentation file:

- Project planning documents;

- Records of resources allocated and timesheets;

- Status and/or progress reports;

- Design of experiments and feasibility plans with details of the methodology adopted;

- Minutes of project meetings;

- Test protocols, data, analysis, results and conclusions achieved;

- Proof of concepts, samples, prototypes with notes on technical challenges to overcome;

- Emails or data extracted from a dedicated project management software system;

- Records from specific team collaboration software packages;

- Invoices in relation to outsourced activity, materials/ P&M used for R&D, etc.;

- Payroll records which reconcile to the salary amounts included in the R&D claim;

- Trial balance/profit and loss statement showing how certain costs in the R&D claim reconcile to the company’s accounting records;

- Details in relation to any apportionment method used for allocating utilities, P&M, etc.

Increase in scrutiny

R&D tax credit claims and costs of the regime have risen sharply in the intervening years since the establishment of the credit, especially in the most recent years. The cost has almost doubled since 2012 alone, although the number of claims has remained steady during this time, indicating that the increase in costs may be due to an increase in project spend within the same number of companies (Table 1).

Table 1: R&D tax credit costs and claim numbers since 2012[4].

Year |

R&D Tax Credit €’m |

Number of Claims |

2012 |

281.9 |

1,543 |

2013 |

421.4 |

1,576 |

2014 |

553.3 |

1,570 |

It is probably inevitable that the rising cost of the credit will result in increased scrutiny of claims. Between 2012 and 2016 the number of Revenue interventions of R&D tax credit claims has increased fivefold (Table 2).

Table 2: Change in Revenue’s R&D Tax credit claim interventions between 2012 and 2016[5]

Year |

Number of Interventions |

Total yield €’000 |

Number Resulting in a Reclaim |

2012 |

49 |

€5,413 |

25 |

2013 |

105 |

€14,483 |

46 |

2014 |

162 |

€10,106 |

75 |

2015 |

178 |

€13,542 |

81 |

2016 |

276 |

€13,714 |

100 |

Total |

770 |

€57,258 |

327 |

An intervention takes the form of a series of actions undertaken by Revenue, generally being one or more of the following:

- Issue of a standard aspect query letter for request of information about the R&D projects and related costs. The number of questions in the letter range from 23 to 25 depending on the Revenue district.

- Revenue audit to review the tax affairs of the company with a focus on one or more R&D tax credit claims made.

- Specific Revenue audit focused solely on the R&D tax credit claims.

In case 2) and 3) above, Revenue may avail of the assistance of external experts, usually drawing from an Irish university, for assistance in the evaluation of the company’s R&D activity claimed.

The increased scrutiny means that now more than ever a high level of diligence in the preparation of claims is required. This involves a) recognising which activities and related costs could be qualifying, and b) ensuring that the relevant documentation is available to support such activities in the event of Revenue querying the claim.

Recent updates

A recent update from the Revenue Commissioners[6] has delivered welcome news for small and micro companies claiming an R&D tax credit. The update aims to minimize the potential administrative burden of an R&D tax credit audit providing that, under certain conditions, ‘Revenue would not, as a rule, seek to challenge a claim for the R&D tax credit under the science test’. These conditions are as follows:

- An IDA/ Enterprise Ireland R&D grant has been approved in respect of the project

- The R&D tax credit claimed for an accounting period (of not less than 12 months) is €50,000 or less;

- The project is undertaken in a prescribed field of science or technology, as defined in regulations S.I. No. 434 of 2004, and

- The company is a micro or small sized enterprise.

According to Revenue, the rationale of the above is found in the common roots shared by the definitions of R&D from both IDA/EI and the R&D tax credit legislation. Both definitions are based on the OECD proposed guidance for the survey of R&D activity (i.e. the ‘Frascati Manual’).

Conclusion

The R&D tax credit can be seen as an attractive source of finance for most innovative companies in Ireland. However, the increase in Revenue interventions should put the focus on companies to pay particular attention to the costs claimed and the evidence prepared to support the R&D activities carried out.

It is recommended that companies in doubt about how to properly assess or record R&D activities for an R&D tax credit claim should seek the assistance of an R&D tax credit professional.

Gianmario Pala is an Associate Director in KPMG’s R&D Incentives Practice. He has several years’ experience preparing R&D tax credit claims in both Ireland and the UK.

Email: gianmario.pala@kpmg.ie

1. Costs of Tax Expenditures (Credits, Allowances and Reliefs) 2014–2016 http://www.revenue.ie/en/about/statistics/costs-expenditures.html

2. Minister for Finance’s response to Dáil question [9328/17] http://oireachtasdebates.oireachtas.ie/Debates%20Authoring/DebatesWebPack.nsf/takes/dail2017022300058#N25

3. Department of Finance Review of R&D Tax Credit 2013

4. Minister for Finance’s response to Dáil question [9328/17] http://oireachtasdebates.oireachtas.ie/Debates%20Authoring/DebatesWebPack.nsf/takes/dail2017022300058#N25

5. Minister for Finance’s response to Dáil question [10378/17]. http://oireachtasdebates.oireachtas.ie/Debates%20Authoring/DebatesWebPack.nsf/takes/dail2017022800068#N16

6. Revenue eBrief No. 17/17 – February 2017