The UK’s implementation of the EU Mandatory Disclosure Regime

There have been significant changes in the UK tax landscape over the last number of years and we have seen the introduction of many new areas of UK legislation.

One area which has undergone significant change is the area of tax disclosure, governance and reporting with some measures introduced as a result of the Base Erosion and Profit Shifting Project (“BEPS”) and some UK-initiated.

In March 2018, political agreement was obtained from the governments of the EU Member States (including the UK) to adopt a new disclosure regime. In order to do this, an amendment was to be made to Directive 2011/16/EU. This Directive deals with the mandatory automatic exchange of information (in the field of taxation) in relation to reportable cross-border arrangements, known as DAC6 for short. DAC6 came into force on 25 June 2018 and is known as the EU Mandatory Disclosure Regime (“EU MDR”).

The UK Government has indicated their commitment to adopting this Directive into UK law, notwithstanding Brexit, and published legislation to do so for consultation on 6 July 2018. The legislation is short and simply allows the Government to make regulations to implement the proposals in the UK. HMRC’s plan is to consult on the regulations and guidance in early 2019, and to make the regulations in late 2019. The current timeline for implementation of the Directive is as follows:-

When and to what does the EU MDR apply?

The new EU DMR rules apply to cross-border arrangements which fall within certain broadly-defined hallmarks.

Intermediaries who are based in an EU Member State will need to disclose reportable cross-border arrangements to their domestic tax authority with these disclosures then shared between the tax authorities of all Member States quarterly.

Whilst the Directive is not fully effective until 1 July 2020, there are transitional rules in place currently and therefore, the rules need to be considered for all transactions taking place on or after 25 June 2018.

What are reportable cross border arrangements?

A reportable cross-border arrangement is an arrangement which meets the following conditions:

- it is a cross-border arrangement; and

- it contains at least one of the hallmarks in Annex IV to the Directive.

A cross-border arrangement means an arrangement concerning either more than one Member State or a Member State and a third country where at least one of the following conditions are met:

- the participants in the arrangement are not all tax-resident in the same jurisdiction;

- one or more of the participants in the arrangement is simultaneously tax-resident in more than one jurisdiction;

- the arrangement involves a permanent establishment which a business carries on in another jurisdiction;

- a participant in the arrangement carries on an activity in another jurisdiction, without being tax-resident for tax purposes or creating a permanent establishment in that jurisdiction; and

- the arrangement has a possible impact on the automatic exchange of information or the identification of beneficial ownership.

The Directive does not define “arrangement”, however, the draft UK legislation says that “arrangements” includes any scheme, transaction or series of transactions.

What are the hallmarks?

The hallmarks are broadly-defined and fall into five categories which are outlined below.

An important point to note is that some of the hallmarks – but not all of them – will only apply where the main benefit, or one of the main benefits, of the arrangement is to obtain a tax advantage (the “main benefit test”). This main benefit test applies to categories A, B and some of those in Category C (being 1(b)(i), 1(c) and 1(d)).

The remaining hallmarks can apply irrespective of whether the main benefit or one of the main benefits of the arrangement is to obtain a tax advantage.

- Category A hallmarks are generic and cover confidentiality, premium fee and standardised tax arrangement hallmarks.

- Category B hallmarks are specifi c hallmarks with a main tax benefi t which include acquiring a loss making company, converting taxable income into capital gains or exempt income, and circular or offsetting transactions.

- Category C hallmarks are related to cross border transactions. These include:

- Deductible cross-border payments, where either

- the recipient is not tax-resident in any jurisdiction;

- (i) the recipient is resident for tax purposes in a jurisdiction that does not impose any corporate tax or imposes corporate tax at the rate of zero or almost zero (this is not defined); or

(ii) the recipient is tax-resident in a jurisdiction which has been assessed as non-cooperative by the EU Member States collectively or the OECD; - the payment benefits from a full exemption from tax in the jurisdiction where the recipient is resident for tax purposes; or

- the payment benefits from a preferential tax regime in the jurisdiction in which the recipient is resident, and the main benefit or one of the main benefits of the arrangement is to obtain a tax advantage

- Deductions for depreciation on the same asset are claimed in more than one jurisdiction

- Relief from double taxation in respect of the same item of income or capital is claimed in more than one jurisdiction

- The arrangement includes transfers of assets, where there is a material difference in the amount being treated as payable in consideration

- Category D hallmarks concern the automatic exchange of information and beneficial ownership and apply even if a tax advantage is not the main benefit. These include structures involving holding companies and trusts, whereby the identity of the beneficial owners are made “unidentifiable”.

- Category E hallmarks concern transfer pricing including arrangements involving unilateral safe harbour rules and arrangements involving the transfer of hard-to-value intangibles. It also concerns arrangements involving an intra-group cross-border transfer of functions and/or risks and/or assets, if the projected annual earnings before interest and taxes, during the three-year period after the transfer, of the transferor(s), are less than 50% of the projected annual EBIT of such transferor(s) if the transfer had not been made.

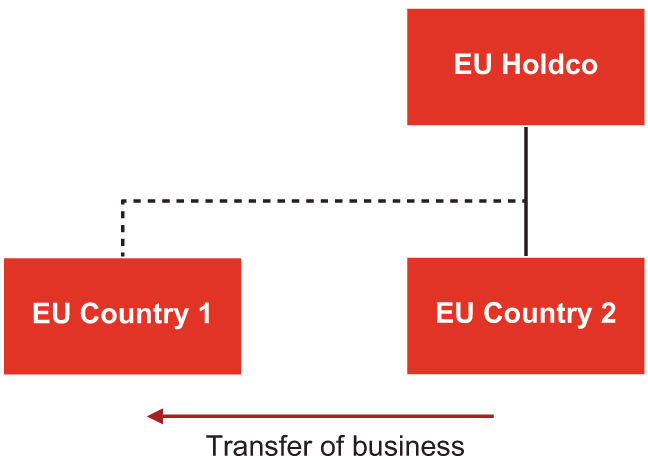

Category E example

In this example, a group relocates part of its operations from EU Country 2 to EU Country 1 for wholly commercial reasons (for example as a result of Brexit planning / accessing talent / reducing costs of manufacturing) and the tax rate in EU Country 1 is higher than in EU Country 2.

In the 3-year period following the transfer of functions and/or risks and/or assets, the projected EBIT of the transferors are reduced by 50%.

As the arrangement does not need to satisfy the main benefit test to be reportable, it is therefore likely to be the case that this is a scenario which is required to be disclosed.

Who has the obligation to disclose?

It may be difficult to determine who is under the obligation to disclose under the EU MDR rules and, given the short timescales for notification, it is critically important to assess this right at the outset.

Where there is an intermediary (e.g. an adviser) based in an EU Member State, the obligation falls on that intermediary. If there are multiple intermediaries, the obligation is on all intermediaries unless there is proof that the information has already been disclosed. Where an intermediary is advising on an engagement which is subject to legal professional privilege then the obligation falls to other intermediaries or, failing that, the taxpayer. If there is a situation in which no intermediary is obliged to make the disclosure, the obligation is on the taxpayer.

What needs to be disclosed under EU MDR?

- Identification of intermediaries and relevant taxpayers including their name, date and place of birth (in case of individuals), tax residence, Taxpayer Identification Number and associated enterprises.

- Hallmarks which are satisfied.

- Summary of the reportable cross-border arrangement.

- Date on which the first step was or will be made.

- Value of the arrangement.

- National provisions that form the basis of the arrangement.

- Member States who are likely to be concerned.

- Identification of any other person in a Member State likely to be affected by the arrangement.

When does a disclosure need to be made?

Once the rules become fully applicable (i.e. on 1 July 2020), intermediaries will be required to file information with their national tax authority, within thirty days of the first of the following dates:

- on the day after the reportable cross-border arrangement is made available for implementation; or

- on the day after the reportable cross-border arrangement is ready for implementation; or

- when the first step in the implementation of the reportable cross-border arrangement has been made; or

- (only when an intermediary is involved) when the intermediary provided aid, assistance or advice.

There could therefore be considerable uncertainty in determining when an arrangement is made available for implementation, is ready for implementation, or when advice is provided.

However, as a transitional measure, where the first step in a reportable cross-border arrangement is implemented between 25 June 2018 and 30 June 2020, the arrangement should be disclosed, but by 31 August 2020.

Conclusion

We are currently in a situation where the rules are applicable but there is no final legislation or regulations. We therefore need to work from the information available to date to undertake analyses on how the EU MDR will apply to transactions from 25 June 2018. These analyses will need to be revisited upon finalisation of the regulations / guidance then updated and disclosures filed where required to ensure compliance with the rules.

The important thing to take away is not to ignore these new rules because there is no imminent reporting deadline – analysing now and retaining the analysis on file to enable a seamless disclosure process when required in August 2020 is the only sensible way to approach these rules.

Sarah Fitzgerald is a Senior Manager with PwC and a Chartered Accountant and Chartered Tax Adviser.

Email: sarah.a.fitzgerald@pwc.com