April 2018 Digital Services update features the latest on Making Tax Digital

Read the update provided to us from HMRC which features the latest on the income tax and Making Tax Digital pilot programmes.

“Making Tax Digital for Business (MTDfB)

Income Tax and VAT Pilots

As you know we took a significant step forward last month with the opening of our pilot for Income Tax on GOV.UK. Agents can now set up an agent services account and sign up to use software to send Income Tax updates on behalf of their clients. Initially we have opened the pilot to self-employed businesses with income from one business. As we develop the service we will add functionality and gradually allow businesses with differing requirements to join. In time, we will make the pilot available to landlords with income from property and all self-employed business.

Agents can now

- Create an Agent Services account

- Link existing SA client relationships to their Agent Services account

- Sign up new and existing SA clients to quarterly updates.

- Submit updates through software – only applies when the agent is subscribed to agent services, the client is signed up to the MTD pilot for Income Tax, and the agent has enabled MTD compatible software for the client

- Be authorised by a new MTD SA client (a digital 64–8 for MTDB).

In addition, their clients will be able to

- digitally confirm authorisation to the MTD pilot for Income Tax, and

- digitally cancel authorisation for the MTD pilot for Income Tax.

We continue to work closely with software developers who are providing software packages to support the Making Tax Digital pilot MTD. As the pilot progresses they will be making a wider range of new or updated software products available to agents and their clients.

In addition to the Income Tax Pilot we will soon launch the VAT pilot. Initially a small number of invited volunteers will test the service. As we are doing with the Income tax pilot, we will add functionality, continue to test and gradually allow businesses of differing types to join. You will be able to sign up your clients to the pilot before April 2019 when it becomes mandatory for those above the VAT threshold to keep digital records for VAT and send their VAT returns through MTD using software.

Thank you for your ongoing work encouraging eligible clients to get involved in both of these pilots.

Communication

We are working on a programme of webinars at the moment. The next one will be Talking Points on the pilot for Agent Services and Income Tax. It will explain how to

- sign up for your agent services account

- sign up your clients for the pilot, and

- submit updates for Income Tax on their behalf using software.

Look out for details on the GOV.UK webpage Help and support for tax agents and advisers. In the meantime, you can watch a recording of recent MTD Talking Points on VAT.

We ran this VAT Talking Points six times, to an audience of over 6,000 agents who gave mainly positive feedback. We are not able to respond to questions once the webinar has ended. However, we have carved out some time to review the 100s of questions we received. We can’t deal with each one separately but we’re working on the best way to provide additional general information or clarification. We’re also looking at how we address the less positive feedback for future sessions.

In due course we will also produce a Talking Points on the VAT pilot. And towards the summer we are planning to do a general MTD update for Talking Points. If there are specific issues you would like to be covered in our MTD webinars please let us know.

Last month we issued the Partner Pack to a number of stakeholders including VCG members. We’re grateful for your feedback which we are reviewing at the moment.

Annual Tax on Enveloped Dwellings (ATED) – returns for 2018/19 period

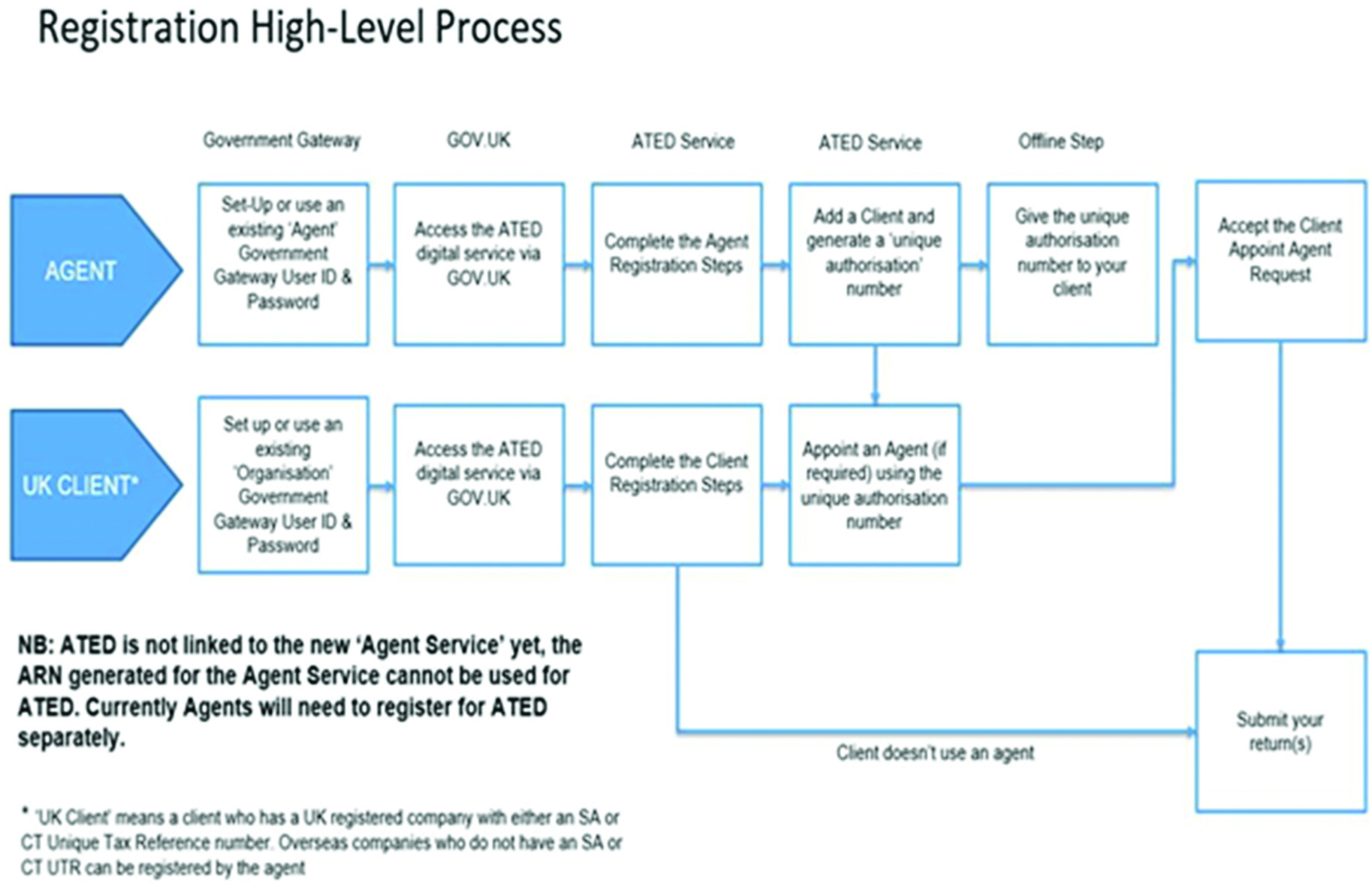

The Agent Reference Number allocated within Agent Services cannot be used when registering for the ATED service because the two services don’t interact. ATED is a standalone service. Agents need to follow the registration process for ATED.

The agent registration process for ATED works as follows:

- Create Government Gateway Credentials, or use existing credentials http://www.gateway.gov.uk

- Go to Gov.UK to register for ATED https://www.gov.uk/guidance/register-for-the-annual-tax-on-enveloped-dwellings-online-service

- Sign in to ATED using GG credentials

- Select business type for the agency

- Enter agency details (e.g. name of firm, UTR)

- Confirm Agency Details

Once this registration process is complete, agents can add clients. While setting up a client, the agent will be provided with a Unique Authorisation Number to pass to their client so that their client can appoint them as agent within the service. This effectively creates a digital ‘handshake’ between the agent and their client. Once this process is complete agents can submit returns on behalf of their client.

Cyber Security

Browser exploitation and Malvertising

HMRC regularly warns about the risks of malicious software (‘malware’) being delivered by email, and being cautious when opening attachments and clicking links. Email is a common method used by criminals, but other techniques are equally dangerous and require different defences. One such technique is exploiting security vulnerabilities in web browsers.

Web browsers and associated software (e.g. plug-ins like Flash) enable users to enjoy a wealth of digital content, in a range of different data formats. There is a lot of complexity behind the scenes in these programs, and security researchers and criminals work hard to find mistakes made by software developers that maintain them. These mistakes often relate to how the web browser processes data within a web page; by crafting the right content, an attacker can get the browser to mistakenly run the attacker’s code. When these vulnerabilities are discovered or reported, the software developers hurry to release software ‘patches’ (updates) to plug the holes.

Not everyone applies these updates though, or they may even use older versions of web browsers that updates are no longer provided for. This presents an opportunity for criminals, who use ‘exploit kits’ – a collection of specially crafted code on a website that will target a wide range of vulnerabilities. Their only challenge is to get potential victims to visit their site – once they do, criminals are able to gain entry and install or run their malicious software. This includes sending out emails with links to these websites, littering social media sites with links, or paying for online adverts which direct victims to the malicious site. The latter technique is referred to as malvertising (derived from malware and advertising), and criminals use a range of techniques to sneak their adverts past the checks of online marketing companies to appear on popular websites. Many legitimate sites have unknowingly hosted malvertising, including household names.

Applying software updates is an important part of keeping your IT systems secure, and generally keeps you safe from this method of attack.

Applying security patches to ensure the secure configuration of systems forms part of the NCSC’s 10 Steps to Cyber Security. Further information on the 10 Steps and other useful guidance can be found on the NCSC website: https://www.ncsc.gov.uk/guidance

Trust Registration Service

The Trusts Registration Service (TRS) allows trustees and personal representatives to register their trust and complex estates online and provide information on the beneficial owners (settlors, trustees and beneficiaries) of the trusts.

Trusts and complex estates should use the TRS in order to request their Self-Assessment (SA) Unique Taxpayer Reference. The TRS provides a single online service for trusts and complex estates, which will allow them to comply with their registration obligations and improves processes around the administration of trusts.

The online TRS will allow HMRC to collect, hold, retrieve and, where allowed by law, share up-to-date information held in a central electronic register. This will help streamline and modernise the use of trust data, in line with the government’s wider digital and transparency agenda.

By collecting the information through the TRS, both HMRC and other law enforcement agencies will be able to draw links between all parties related to assets held in a trust. This will help prevent the use of trusts for money laundering and terrorist financing.

Registration deadlines

Trusts and complex estates that have incurred a liability to income tax or capital gains tax for the first time in the tax year 2017 to 2018 will need to complete registration on the TRS by no later than 5 October 2018.

The trustees of an existing trust that have incurred a liability to tax in the tax year 2017 to 2018 must register accurate and up-to-date beneficial ownership information about the trust, using the TRS by 31 January 2019.

Some agents are continuing to send in paper registration forms instead of using the online registration service. In these instances we will be rejecting the paper forms and instructing agents to complete the registration online instead. We are aware that some agents encountered problems with Agent Online Services but these issues were fully rectified by 12 January 2018. We will ask for an online registration to be made within 6 weeks of the issue date of the paper form rejection letter.

Penalty framework

HMRC has now published the details of the penalties framework for TRS.

HMRC will not automatically charge penalties for late TRS returns. Instead, we will take a pragmatic and risk based approach to charging penalties, particularly where it is clear that trustees or their agents have made every reasonable effort to meet their obligations under the regulations. We will also take into account that this is the first year in which trustees and agents have had to meet the registration obligations.

Updating TRS

HMRC are implementing the TRS in a number of phases. Currently, it is not possible for lead trustees and their agents to update their registered information or to declare that there have not been any changes to their registered information on the TRS. Further updates on when that functionality is implemented will be provided in future Newsletters. In the meantime, please do not send HMRC this information. However, if you need to inform HMRC that the lead trustee or trust correspondence address has changed, please do so as by writing to us at:

Trusts,

HM Revenue and Customs,

BX9 1EL”

END OF HMRC UPDATE