Survey Results & Analysis for E-Filing of Personal Tax Returns Survey

Introduction

This report contains a detailed statistical analysis of the results to the survey titled E-Filing of Personal Tax Returns Survey. The results analysis includes answers from all respondents who took the survey in the period from Monday, 6 November, 2006 to Friday, November 24, 2006. 996 completed responses were received to the survey during this time.

The survey was devised and widely publicised by ICAEW, ICAI, ICAS, CIOT, ACCA, ATT and AAT as practitioner representatives on the WT E-subgroup, and hosted by ICAI. We are also grateful to Taxation magazine for publicising the survey and for agreeing to report its findings.

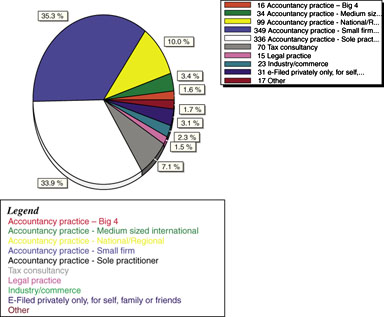

Which best describes the type of organisation you work in?

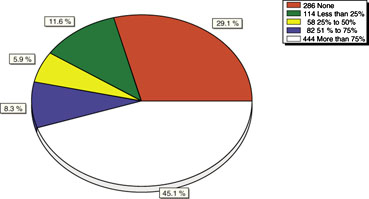

What percentage of Income tax returns were e-filed (either by ELS or FBI) in your organisation last year?

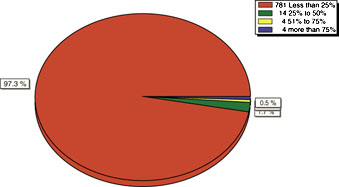

What proportion of the returns which you filed last year were rejected?

Please indicate up to three reasons for e-filing rejections (Please tick all that apply):

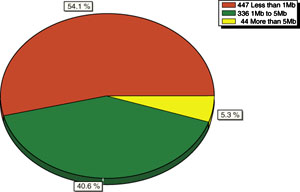

Now that we have persuaded HMRC to allow the electronic attachment of additional information, what is the largest total attachment you might need to send?

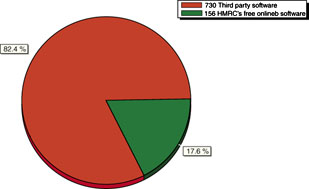

On which e-filing software do you primarily rely:

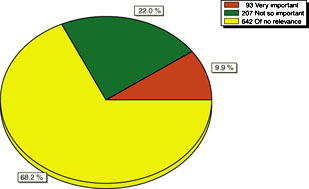

Some taxpayers cannot e-file, for instance MPs, judges and employees of the security services. It is a priority for your firm that such groups be included in e-filing?

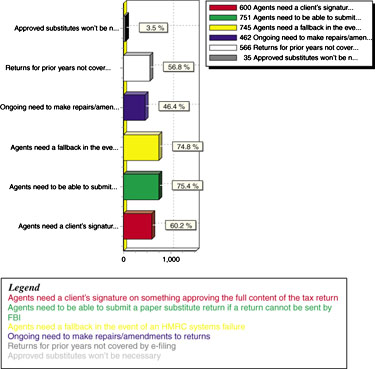

If you believe that HMRC – approved substitute returns will still be needed after the proposed withdrawal date (2008), please tell us why (Please tick all that apply):

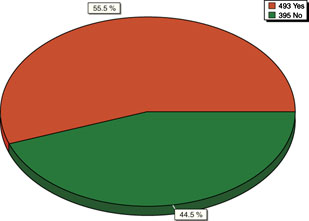

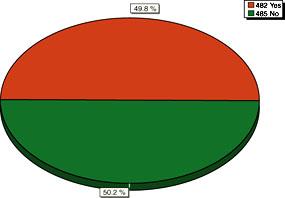

Are the current arrangements for online agent authorisation (64-8) satisfactory?

Are you willing to arrange tax payments online, either for yourself or on behalf of others?

From this list, can you tell us the single item you find most problematic about electronic filing? (If you wish to elaborate, please email further details to your professional body.)

What other types of return might you file on-line? (Please tick all that apply)

Of which professional body are you a member? (Please tick all that apply)