Results & Analysis for ROS Survey-Income Tax Returns

Introduction

This report contains a detailed statistical analysis of the results to the survey titled ROS Survey-Income Tax Returns. The results analysis includes answers from all respondents who completed the survey in the period from Thursday, 15 February, 2007 to Wednesday,March 21, 2007. 155 completed responses to the survey were received during this time.

In addition, some respondents provided more detailed comments on ROS, which have been reproduced in the Appendix to this report.

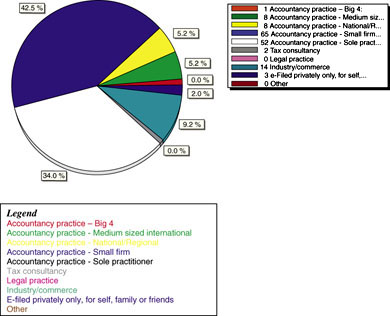

Which of the following best describes the organisation you work in?

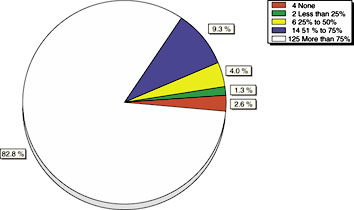

Roughly, what percentage of Income Tax returns were electronically filed through ROS in your organisation last year?

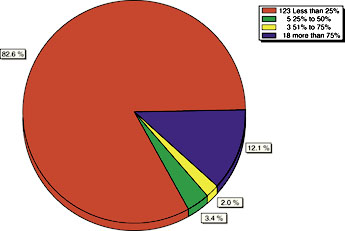

What proportion of the returns would you have filed, but could not, through ROS?

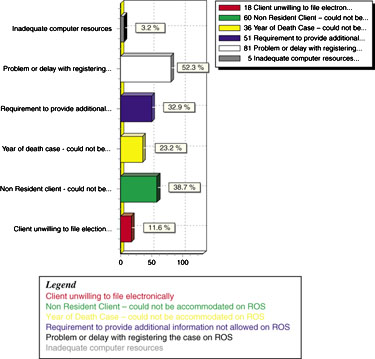

Please indicate up to three reasons for not being able to use ROS on a case:

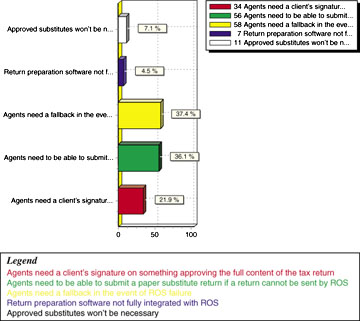

If you believe that Revenue approved facsimile returns of income will still be needed this year, please tell us why?

Are the current arrangements for registering clients on ROS satisfactory:

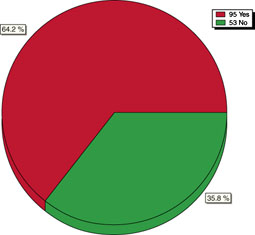

Are you willing to arrange tax payments online, for example by instructing a specific payment, either for yourself or on behalf of others?

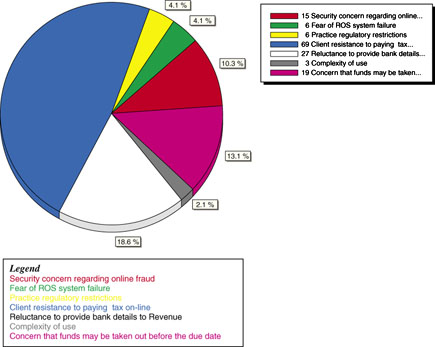

The level of on-line payments does not match the level of on-line filing. Please tell us what you think might be the main reason for this.

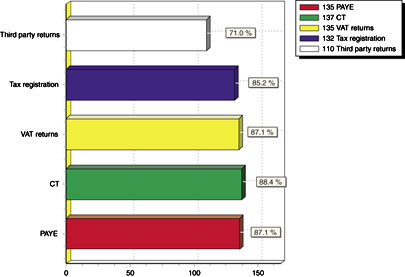

What other types of return might you be willing to file on-line?

Appendix

Detailed Comments from Respondents

Comment 1:

“We are real ROS users here in this office, one change in the processing system that we would find useful is an ability to change the payment set up at the time of filing a return, for example we have a few 2006 returns ready for filing and would like to pay and file the return but the client wants to keep their options open with regard to, say, additional pension contributions.

We will file the return now but will not set up the payment details on ANY early filers because we cannot make a change to payments set up. From our point of view this is hassle as we now must keep yet another list of clients where payments are due, and must revisit these files to set up the payment details.

If we could make changes to the payment details on ROS then we could pay and file all returns in the first instance and only revisit the files of those clients who are making changes to their payment details.”

Comment 2:

“I recently came across something that caused me great concern with respect to the payment of a tax liability. The liability was paid by single debit authority but the bank details entered on same were not that of the person liable but of another individual. The error in this case – which came to light due to the examination of bank statements by the individual-was completely innocent and was rectified within a month. However it demonstrated how easy it is to be fraudulent. Also – if the individual had not discovered the error as quickly would same have been rectified at all – I think if it had been queried later following a tax account reconciliation – Revenue's answer would have been that it was paid – end of story.

I would like to see Revenue put in place the following so that this mistake – however innocent can never occur again:

- The end of paper direct debit payment authorities on individual returns.

- A feed back question from Revenue where account details differ from that nominated on the tax registration form.

The above has implications for ROS filing as well as for paper filing as the ROS bank details can be amended quite easily – as far as I am aware.”

Comment 3:

“Our main issue is with the apparent inconsistency of application of penalties. We have clients on ROS who would be highly compliant but go through a period of late returns and subsequently be charged interest for minor lateness, it seems, automatically. The perception is that paper filers will continue to “get away with” lateness particularly if only a day or two.

My point is that Revenue are penalizing (at least with reference to non-ROS users) the very taxpayers that are making the effort to facilitate Revenue by using ROS.”