Self-Assessment & Stamp Duty

The Finance Act 2012 introduced important changes that will affect the way stamp duty operates for instruments and deeds executed on or after 7th July 2012. This note outlines the main changes and explains how they will affect your stamp duty return.

1: The Stamp Duty Return

In the main, e-stamping users will find no change in the way they currently use the system and will see very few changes to the e-stamping screens in filing returns. The e-Stamping system will direct returns for instruments executed on or after 7th July automatically into self-assessment treatment. Returns for instruments executed before July 7th will continue to be treated as at present and the screens for these returns remain unchanged. The format of the paper return has been updated also to reflect the application of self-assessment to instruments executed after 7th July. However, as on-line returns are mandatory for stamp duty, very few paper self- assessed returns will be filed.

Where the new self-assessment regime applies, practitioners will see the following main changes to the e-Stamping screens (and associated paper returns where applicable) for instruments executed on or after 7th July only.

- The option to select adjudication will not be available.

- The Summary and Calculation screen will show the heading ‘Self-assessed

Summary and Calculation’ (See figure 1 in the Appendix).

The screens presented for instruments executed before 7th July will remain unchanged and the e-stamping system will continue to process returns executed before this date in the same way as it currently does.

The changes to the e-Stamping screens for self-assessed returns are illustrated at Appendix 1.

2: Key Changes under Self Assessment

The key changes introduced by stamp duty self-assessment are in the following areas

- the removal of adjudication for instruments executed on or after 7th July 2012;

- replacement of late penalties with a late filing surcharge to apply to instruments executed on or after 7th July 2012;

- New requirements for expressions of doubt.

- Certificates no longer required to be placed in the instruments

These changes do not apply to instruments executed prior to 7th July 2012.

3: Removal of adjudication

The Finance Act 2012 provides for the removal of adjudication and the treatment of all stamp duty returns for instruments executed on or after 7th July 2012 on a self- assessed basis. This means that the e-stamping system will no longer apply adjudication to any instrument executed on or after 7th July 2012 and the return will not provide filers will an option to select adjudication.

Practitioners will continue to file e-Stamping returns as at present, but on the basis of their own assessment of the stamp duty liability and without the requirement to present the instrument for examination by Revenue. Provided all charges are fully paid, and the option to lodge an expression of doubt is not selected, the filer will receive the stamp certificate immediately into their ROS inbox, as currently happens with ‘straight’ stamping cases. Returns for instruments executed prior to 7th July 2012 will continue to be treated as heretofore.

The e-Stamping system will ensure that returns for instruments executed on or after 7th July will be automatically routed into the self-assessment system by reference to the date of execution entered on the return.

Figure 1 – Treatment of Stamp Duty Returns Pre and Post 7th July 2012

Example 1:

A practitioner files a return on 31stJuly 2012 in respect of a deed executed on 8thJuly 2012. The return includes a claim for Young Trained Farmers Relief. In this case, the filer will file the return claiming the relief on a self-assessed basis and s/he will receive a stamp certificate immediately without the instrument being presented to Revenue. The filer will notice a slight change to the Summary Calculation screen that now reads ‘Self Assessed Return Summary & Calculation’. In addition, the filer will see a slight change to the title of his/her “List all Details” button, which will now read ‘Self Assessed Return List All Details’

Example 2:

A practitioner files a return on 31stJuly 2012 in respect of a deed executed on 6thJuly 2012, i.e., before the self-assessment effective date of 7thJuly 2012. The return includes a claim for Young Trained Farmers Relief. In this case, the screens presented to the filer will be unchanged from the present screens and the filer will not receive a stamp certificate immediately as the instrument is subject to adjudication. As at present, the filer must present the deed and other supporting documentation to Revenue and await Revenue adjudication.

4: Penalties and Duty Surcharge

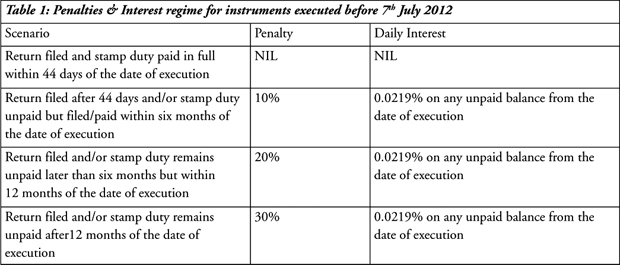

A new late-filing duty surcharge provision will apply to instruments subject to self assessment, that is, instruments executed on or after 7th July 2012. The existing penalty provisions will continue to apply to instruments executed before 7th July 2012 regardless of the date the return for these instruments is filed.

Under self-assessment, the stamp duty return must be filed on or before the specified return date, that is, 30 days after the date of execution. In practice, Revenue will continue to accept returns filed up to 44 days after execution. Returns filed after this date, (filed ‘late’), will attract a duty surcharge of 5%, up to a maximum of €12,695. The duty surcharge increases to 10% if the return is filed later than 62 days after the specified date, i.e., 92 days after the date of execution, up to a maximum of €63,495.

Figure 2 -

It is important to note that the duty surcharge is a filing surcharge and will apply to returns filed after the specified date, regardless or whether duty is paid or not at the time of filing. In another example, if a practitioner files a return within 44 days of the date of execution but does not pay duty until after the 44th day, s/he will not incur the late filing surcharge, but will incur daily interest charges on the unpaid balance.

Practitioners should note that the duty surcharge will have the effect of increasing the amount of the duty and daily interest will be levied on the total of the original stamp duty liability plus the surcharge amount.

The following tables illustrate the main differences between the new self-assessment duty surcharge and interest regime and the existing ‘late’ penalty and interest regime.

5: Expression of Doubt

Where a practitioner has a genuine doubt over the legislative interpretation of a matter or circumstances affecting the calculation of stamp duty in a return, s/he can lodge an expression of doubt with Revenue. To lodge an expression of doubt, the filer should select the Expression Of Doubt (EOD) tick box on the e-Stamping “consideration” screen (i.e. the last screen before reaching the Self Assessment Summary & Calculation screen-see Figure 2 in the Appendix), file the return with Revenue, paying the duty s/he believes to be correct, and set out the full circumstances to Revenue in a separate communication.

Selecting the EOD option in the return prevents the stamp certificate being issued until Revenue has examined and determined upon the point at issue. The practitioner must furnish a letter to Revenue, clearly marked as “expression of doubt”, and this letter must:

- set out the full details of the facts and circumstances affecting the liability of the instrument to stamp duty, making specific reference to the legal interpretation at issue

- identify the amount of stamp duty in doubt and

- be accompanied by relevant supporting documentation

Where Revenue accepts that the practitioner's interpretation is correct, Revenue will approve the return as filed and the stamp certificate will issue to the filer's ROS inbox. Alternatively, Revenue will notify the filer that his/her interpretation is incorrect and an emended return will need to be filed. Once the filer receives this notification, s/he will have 30 days within which to lodge an amended return and pay the additional duty without incurring interest (the duty surcharge will not apply). If the amended return and/or additional duty payment is late, interest will be charged on the balance unpaid back to the date of execution.

It is important to note that this interest-free period will not be applied if the filer lodges a fresh return rather than amending the original return.

5.1 EOD and late Filing

The facility to lodge an EOD is available only for returns filed within 44 days of the date of execution of the instrument. On-line returns filed ‘late’ will not display the EOD tick box. Revenue will reject paper returns received late where the filer has selected EOD. Where a properly prepared EOD letter, as referred to above, is not received by Revenue within 44 days, this too will result in the EOD being rejected by Revenue.

5.2 Genuine and ‘not genuine’ EOD

Where an EOD is genuine and Revenue agrees with the filer's position, Revenue will simply release the stamp cert to the filer.

The Act provides for Revenue to reject an EOD as ‘not genuine’ where:

- Revenue has issued general guidelines concerning the application of the law in similar circumstances

- Revenue is of the opinion that the matter is sufficiently free from doubt so as not to warrant an expression of doubt, or

- Revenue is of the opinion that the accountable person is acting with a view to evasion or avoidance of the duty

Where Revenue concludes that an EOD is not genuine, Revenue will issue a notice of rejection setting out the reasons. On receipt of the notice, to receive their stamp certificate, the filer should lodge an amended return immediately (with the EOD box ‘unticked’ if still available) and notify Revenue that an amended return has been filed. The stamp certificate will be released provided that the full liability, as calculated in the amended stamp duty return, has been paid.

Where Revenue disagrees with the point at issue in an EOD accepted as genuine, Revenue will notify the filer of the determination. The filer is obliged to lodge an amended return on foot of this determination, taking care to avoid selecting EOD again, if the tickbox is available on screen. Where the amendment results in an increase in duty, interest will not be charged provided the increased amount is paid within 30 days of the date of the notification from Revenue. The filer should notify Revenue when the amended return has been filed. Revenue will then release the stamp certificate provided that the full liability has been paid as calculated in the amended stamp duty return.

5.3 Appealing the Rejection of an EOD

Where a practitioner disagrees with Revenue's rejection of an EOD as not being genuine, s/he can lodge an appeal with the Appeal Commissioners. It should be noted that the appeal will be limited to the issue of whether Revenue had sufficient grounds for rejecting the EOD. The appeal will not review the substance of the duty liability.

The filer may avail of the option to appeal the rejection to the Appeal Commissioners. If the Appeal outcome agrees with Revenue's position the EOD remains rejected, interest continues to accrue on any outstanding duty balance and the filer must lodge an amended return and pay any outstanding liability (including interest on any balance due) to get their stamp certificate. If the Appeal finds in favour of the filer, Revenue will be obliged to treat the EOD as genuine.

5.4 Interest Charges and EOD

The filer may lodge a return on time with EOD selected but the duty assessed on the return must be paid on time also, or daily interest will apply to the unpaid balance after 44 days, regardless of the EOD outcome. In these cases, interest will be charged from the date of execution of the instrument to the date of payment.

Where an EOD is accepted as genuine and the review of the case by Revenue results in an increased liability, any increase in duty resulting from the review is not subject to interest for 30 days after Revenue issues its ruling. If the filer has not filed an amended return and/or paid any outstanding duty balance by day 30, they are liable for interest on the outstanding balance from day 31. The interest will be calculated from the date of execution to the date of payment, on the daily outstanding balance as calculated in the amended return.

If, in this case, Revenue's review of the EOD results in a different treatment and a higher duty charge, the filer must submit an amended return showing the higher charge. The filer has 30 days to submit the amended return and pay the duty, before interest is charged on the higher amount (in addition to the interest accruing on the unpaid original liability). If they do not act by day 30, the return is subject to daily interest, from the original date of execution, on the full outstanding balance.

If a person files for EOD but fails to pay all duty on time, then has their EOD rejected by Revenue, but succeeds at appeal in getting it accepted as genuine, they are still liable for daily interest on the unpaid balance. If, in this case, Revenue finds that a higher amount of duty is due, the filer continues to incur daily interest on the ‘original’ outstanding balance until its paid, but is allowed 30 days after Revenue notification to file an amended return and pay before being charged interest on the higher amount.

If they file an amended return and pay the full amount of duty outstanding (total of duty from original and amended return) by day 30, no interest charge will apply to the increase. Assuming the filer has paid any daily interest accrued from any delay in paying the ‘original’ duty balance on time, the stamp certificate will issue automatically on closure of the EOD.

If the filer in this case fails to file an amended return and pay the increased duty by day 30, they are liable for daily interest, from the date of execution of the instrument, on the full balance unpaid.

6: Finance Certificates in Deeds

The requirement to insert Revenue certificates in deeds no longer applies for deeds executed on or after 7th July 2012. However, this requirement continues in respect of all deeds executed before 7th July 2012. Please go to the following link for the easiest way to check certificate requirements-http://www.revenue.ie/en/tax/stamp-duty/certificates/index.html

7: Information Sources

Comprehensive legislative, guidance notes and other useful stamp duty information is available on the Revenue website at http://www.revenue.ie/en/tax/stamp-duty/e-stamping/index.html

The following link will bring you to the relevant self-assessment legislation. http://www.irishstatutebook.ie/2012/en/act/pub/0009/sched3.html#sched3

APPENDIX 1 Figure 1 Self Assessment Screen

APPENDIX 2

New Surcharge & Interest Calculation for Late Filing Examples

Example 1:

A return is filed 40 days from execution. The duty liability is €4,000. As the return was filed within 44 days, no surcharge will apply.

No payment is furnished until 90 days after execution at which stage only half the duty (€2,000) is furnished. Daily interest will be charged on the unpaid balance from the date of execution.

Following the payment of €2,000, daily Interest of 0.0219% will continue to accrue on the outstanding duty of €2,000 until paid.

Example 2:

A return is filed 50 days after execution. The duty liability is €2,000.

As the return is filed after 44 days but before 92 days from execution a 5% (€100) surcharge will apply.

Daily interest (0.0219%) will apply to the duty and surcharge from the date of execution to date of payment:

Example 3:

A return is filed 122 days after execution. The duty liability is €2,000. A surcharge of 10% of duty (€200) will apply.

Interest will accrue on the duty and surcharge (€2,200) until paid in full.

Source: Revenue Commissioners. www.revenue.ie. Copyright Acknowledged.