Stamp Taxes Bulletin 1/2013

All Taxes

Changes to Telephone/Fax Numbers

Stamp Taxes has a new fax number which is 03000 570 316

Stamp Duty - there is a new telephone number for same day stamping which is 03000 570 320

Land

Disadvantaged Areas Relief (DAR)

Following legislation at S227/SCH39/FA12, DAR will be abolished for transactions with an effective date on or after 6 April 2013.

The relief currently applies to purchases of residential property in qualifying areas where the purchase price does not exceed £150,000. Follow the link below for guidance on the relief available in the SDLT Manual (SDLTM).

SDLTM20050 – Reliefs: disadvantaged areas relief

All claims to relief for purchases of residential property where the effective date is before 6 April 2013 must be made on or before 5 May 2014. Claims made after that date cannot be accepted. This applies whether or not the claim is made in a land transaction return or an amendment of such a return.

The transitional provisions at PARA4/SCH9/FA05, which were introduced when DAR for non-residential properties was abolished, will remain in force. These provisions apply to certain acquisitions of non-residential property in pursuance of a contract entered into on or before 16 March 2005.

Please note that the deadline for residential DAR claims under Stamp Duty is 6 May 2015 (not 2014) under the normal two-year time limit for Stamp Duty claims.

New Annual Tax on Enveloped Dwellings (ATED)

As announced in Budget 2012, and following consultation over the summer, legislation will be introduced for an annual tax on enveloped dwellings. This is to be payable by certain ‘non-natural persons’ (companies, partnerships with company members and collective investment schemes). It is payable if they own interests in dwellings with a value of greater than £2 million on certain dates.

This tax is intended to deter the ‘enveloping’ of residential dwellings into corporate envelopes in order to avoid a future Stamp Duty Land Tax (SDLT) liability on a future acquisition of the property by selling shares in the envelope rather than the property itself, and, to ensure that those people who retain dwellings within envelopes pay their fair share of tax.

The legislation came into effect on 1 April 2013. It is an annual tax, and returns and payments will be required annually. Returns will usually be due on 30 April with payment on 30 April, but for the first year returns will be due on 1 October 2013 and payment by 31 October 2013. The amount of tax payable will depend upon which of the fixed bands the dwelling is within. There are a number of reliefs available to taxpayers to cover cases where the dwelling is being, or is to be, used for genuine commercial activities, or is owned by certain categories of person; charities, diplomatic missions etc.

Annual tax on enveloped dwellings (PDF 1.32MB) – paragraph 1.39, please also see the Tax Information and Impact Note (PDF 54K)

15 Per cent SDLT

At Budget 2012 a rate of 15 per cent SDLT was introduced on company (and certain other) acquisitions of residential dwellings costing more than £2 million, and plans were announced for a new ATED on such dwellings owned by companies, partnerships with company members and collective investment schemes. The aim is to deter homeowners from holding their properties in companies aiming, by in due course selling the shares in the company, to avoid a future SDLT liability when they sell the property.

As a result of consultation on these measures, a number of reliefs will be introduced against the 15 per cent rate where holding a residential property in a company is a sensible commercial choice. The reliefs will reduce the rate of SDLT to 7 per cent, where the property is used for a property rental business, a property development or resale trade, for providing admission to visitors on a commercial basis and in certain other situations.

There is also to be a 3 year period where if the commercial use of the residential property ceases, or it begins to be occupied by an individual who controls the company or other entity holding the dwelling, the additional 8 per cent SDLT is clawed back from what would have been its due date.

Reliefs from 15 per cent rate of SDLT (PDF 1.32MB) - paragraph 1.40, please also see the Tax Information and Impact Note (PDF 54K)

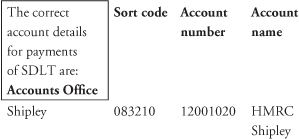

Paying SDLT Into the Correct Bank Account

Getting a payment reminder when you have already paid is irritating, time-consuming and causes additional work for everyone. Often, reminders are issued because the money has been paid into the wrong HM Revenue & Customs (HMRC) bank account. This includes SDLT being paid into the account for Stamp Duty.

To help avoid unnecessary delays and cost, it is important to follow the right procedures and provide the correct information. This will help ensure that money is credited to the right bank account number for the relevant tax, within the required timescale. To make sure this happens HMRC recommends that you make all of your SDLT payments electronically.

Source: HM Revenue & Customs www.hmrc.gov.uk Copyright Acknowledged.