Tax Treatment of Vodafone Return of Value to Shareholders

Return of Value to Vodafone Group plc (“Vodafone”) Shareholders & related share consolidation by means of a scheme of arrangement under Part 26 of the UK Companies Act 2006

This guide relates solely to former Eircom shareholders who acquired their Vodafone ordinary shares in exchange for Eircom shares in 2001. It sets out the tax position in respect of the Return of Value and share consolidation which was effected on 21 February 2014.

Shareholders who acquired Vodafone ordinary shares otherwise than by the exchange of Eircom shares should calculate their chargeable gain or loss by reference to the price paid for their shares, adjusted as may be necessary for any subsequent events and for part-disposal rules.

Background

On 2 September 2013 Vodafone announced that it had agreed to sell its US group whose principal asset is its 45% interest in Verizon Wireless to Verizon Communications Inc. (“Verizon”).

Vodafone also announced that it intended to carry out a return of value to shareholders, partly in cash and partly in Verizon Consideration Shares method by which this value was returned to shareholders was by the issue by Vodafone of B Shares (“Capital Option”) or C Shares (“Income Option”) to shareholders.

Opting for the B Shares (Capital Option) means that the return of value will be subject to capital gains tax treatment.

Opting for the C Shares (Income Option) means the return of value will be subject to income tax treatment.

The terms of the Scheme are as follows:

Under the terms of the Return of Value and share consolidation, Vodafone shareholders received the following:

- 6 New Vodafone Ordinary shares for every 11 existing Vodafone ordinary shares

- 0.0263001 Verizon Shares for every Vodafone Share

- Cash of €0.3585437 for every Vodafone Share (US$0.4928005 converted at a rate of €1 to $1.37445)

Each Vodafone Shareholder has been informed by Computershare/Vodafone/Verizon of details of the exact amounts received by reference to the number of shares held in Vodafone at the time of the Return of Value and Share Consolidation. These amounts should be used when calculating any capital gains tax or income tax, PRSI, USC liability.

Capital Gains Tax Treatment applicable to Former Eircom Shareholders.

Vodafone shareholders who acquired their shares in exchange for Eircom shares in 2001 will not have a capital gains tax liability, as the following calculations show:

Example 1.

CGT Computation of shareholder who opted for the Capital Option and Sale of the Verizon Shares: An Individual with 1000 Vodafone Shares received the following: |

|

Cash (1000 × €0.3585437) |

€358.54 |

26 Verizon Shares |

|

(Price per share €34.0835897) |

€886 |

545 New Vodafone Ordinary Shares: |

|

Cash in respect of fractional entitlements in Vodafone Ordinary Shares and Verizon shares (assumed Nil in this example). |

|

Computation

Amount of Consideration (Return of Value) on 1000 Vodafone Ordinary Shares

Cash |

€ 358 |

Verizon Share Value |

€ 886 |

Total Consideration |

€1,244 |

Less Part of Base Cost applicable to this part-disposal |

|

Base Cost (See Note 1 below) |

1,965 |

Net Loss |

(721) |

Example 2.

CGT Computation of shareholder who opted for the Capital Option and retained the Verizon Shares:

Computation (using the same 1000 share example as above).

Amount of Consideration (Return of Value) on 1000 Vodafone Ordinary Shares |

|

Total Consideration – Cash |

€ 358 |

Less Part of Base Cost applicable to this part-disposal |

|

Base Cost (See Note 1 below) |

565 |

Net Loss |

(207) |

No capital gains tax is payable by former Eircom shareholders, as they have a CGT loss

€721 or €207 in the examples above - which is available to be offset against other chargeable gains (if any) or, if unused, to be carried forward to be offset against chargeable gains in the future.

Indexation of the Base Cost has not been included in the examples, as no CGT liability arises. Fractional entitlements have been disregarded.

Income Tax Treatment

Individuals who opted for the Income Option (“C” shares) or failed to indicate either option, will have received a dividend from Vodafone consisting of two elements – a cash amount and shares in Verizon. This dividend will be taxable in the same way as all previous Vodafone dividends. The amount of the dividend that each individual should declare for income tax purposes is the sum of the cash actually received (€358 based on example 1 above) and the market value of the Verizon Consideration Share Entitlement received (€886 as per the same example 1).

Individuals aged 65 years of age or over can claim exemption from income tax in 2014 if their total income for the year, including pensions and other income (such as Vodafone/Verizon Dividends), is less than:

- €18,000, if single, widowed or a surviving civil partner, or

- €36,000, if married or in a civil partnership.

Individuals taxed through the PAYE System

Individuals who pay tax through the PAYE system and have net assessable non-PAYE income [*] of less than €3,174, can have the tax due on the non-PAYE income collected by offset against their tax credits either by:

- Where Using PAYE Anytime – Entering in the “UK Dividends” box, the amount of the payment received (€1,244 in example 1 above).

[If not registered for PAYE Anytime, a PAYE taxpayer can do so by logging on to www.revenue.ie and selecting ‘Register for PAYE Anytime’].

or - Contacting their Revenue office – and providing details of the dividends.

Revenue will then reduce the PAYE tax credits by the amount of the dividend income and will issue a new Tax Credit Certificate. Revenue will also send a new notice to employers showing the reduced tax credits to be applied in payroll. In this way the tax due on the Vodafone income will be collected from salary/wages through the PAYE system.

Individuals taxed through the Self-Assessing System

Individuals who are “chargeable persons” subject to Self-Assessment are required to include all their assessable income on their annual tax returns (Form 11). Individuals who in addition to paying tax through the PAYE system, have net assessable non-PAYE income [*] of €3,174 or more in any year of assessment are chargeable persons and must complete a Form 11. The amount of the Vodafone income (€1,244 in example 1) should be included in the Form 11. The dividends are liable to Income tax and USC, and may also be liable to PRSI depending on taxpayers’ personal circumstances.

* NOTE: Net assessable non-PAYE income includes income after losses, capital allowances and reliefs have been factored in. It also includes dividends such as the Vodafone dividends and deposit interest subject to DIRT.

Shareholders who retain ownership of Verizon shares should also refer to Note 3 (below) in relation to the tax position applicable to any future Verizon dividends they may receive.

Querie:

Queries on any aspect of this Guide may be made to:

Ronán Connolly, Capital Taxes Branch, Revenue Commissioners

Telephone 6748900. Email: ronan.connolly@revenue.ie

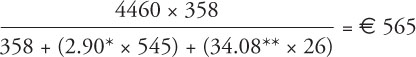

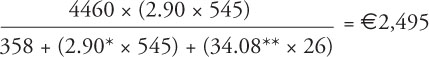

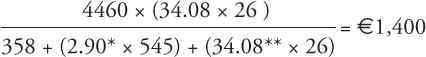

Section 584(6) TCA 1997 contains the main rule for apportioning the cost of the original holding amongst the various elements of the new holding. This note sets out the apportionment of the base cost of €4.46 per old Vodafone Ordinary Share (see Note 2 below). This base cost is apportioned between the three elements in the Return of Value and Share Consolidation (using the example of 1000 old Vodafone Ordinary Shares) as follows:

Apportioned to the Cash element of €358:

Apportioned to the new Vodafone Ordinary Shares:

This amounts to €4.58 per share ( i.e. €2495/545 shares).

€4.58 per share can be taken as the base cost of the new Vodafone Ordinary Shares by former Eircom shareholders in the event of a future disposal (subject to any future adjustments in the shareholding).

Apportioned to the Verizon Shares:

This amounts to €53.85 per share (i.e.€1400/26 shares)

€3.85 per share can be taken as the base cost of the Verizon shares by former Eircom shareholders who retained ownership of the Verizon shares, in the event of a future disposal (subject to any future adjustments in the shareholding).

* The market value of the new Vodafone Ordinary Shares, (calculated in accordance with Section 548 (3), Taxes Consolidation Act 1997) on the first day on which they were listed (24 February 2014) after completion of the Return of Value to shareholders & related share consolidation, is £2.3925/0.825 (exchange rate) = €2.90 per share.

** The figure of €34.08 in relation to Verizon shares is the price shareholders who opted to immediately sell them obtained for them. Revenue will accept this price as the market value of the new Verizon Shares for the purposes of apportioning the base cost of the original Vodafone Ordinary Shares held by former Eircom shareholders

Note 2. Base Cost of old Vodafone Ordinary Shares

The base cost figure of €4.46 per share (used in the above examples) is calculated as follows for shareholders who acquired their Vodafone ordinary shareholding in exchange for Eircom shares in 2001.

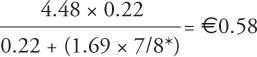

In December 2005, Revenue accepted that the base cost of the Vodafone ordinary shares for former Eircom shareholders could be taken to be €4.66 and that the loyalty bonus shares of 1 for 25 received had a nil base cost. Accordingly, the adjusted base cost at that time was €4.48.

On 28 July 2006, a share consolidation of 7 new shares and a cash payment of £stg0.15 (€ 0.22) for every 8 shares held was made by Vodafone. £stg1.16 (€1.69) was the price of Vodafone ordinary shares on 31 July 2006 following consolidation. The €4.48 cost is adjusted to take account of this cash payment and consolidation:

* Note: This 7/8ths adjustment was overlooked in the initial version of this guide.

Adjusted Base Cost: €3.90 (4.48 – 0.58).

This figure of €3.90 is further adjusted to take account of the ‘7 for 8’ share consolidation:

€3.90 × 8/7 = €4.46 per share.

Note 3. Income Tax Treatment of future dividends in respect of Verizon shares.

This note is only of relevance to Irish resident shareholders who retained their Verizon shares.

Irish resident shareholders who received shares in Verizon and who chose to keep them should note that any future dividends payable on the Verizon shares will be subject to Irish income tax or corporation tax, as appropriate.

Dividends paid on Verizon shares will generally be subject to US withholding tax which is 30 per cent of the gross amount of the dividend.

However Irish resident shareholders who make a claim to the US authorities under the United States-Republic of Ireland Double Taxation Treaty will be entitled to a reduced rate of withholding tax which is currently 15 per cent.

This claim can be made by completing “Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding” (a copy of which was supplied by Computershare to shareholders who retained their Verizon shares) and by sending it to Computershare as indicated on the Form. Credit for such withholding tax may be available for set-off against a liability to Irish income tax or Irish corporation tax on the dividends. The credit will be the lower of the Irish effective rate on the dividends or the rate provided for by the United States – Republic of Ireland Double Taxation Treaty i.e. 15%.

Source: Revenue Commissioners. www.revenue.ie Copyright Acknowledged.