Pre-sale restructuring – the importance of an informed buyer

Good news - regular deal flow has resumed. Irish companies are looking to expand their markets. International players are looking at Irish companies as opportunities for expansion or for access to technologies. Some funding has come in to the market while others are spending cash which they have been previously hoarding for rainy days.

Deals often trigger pre-sale restructuring in order to put businesses together or hive off unwanted parts. At one end of the scale, minimal, if any, pre-sale restructuring may be required. The target business may already be neatly boxed off in a target company. The shares in the target are offered for sale to the buyer. At the other end of the scale, the sale process can require that the seller tidies up its complex group structure in order to facilitate the sale of the target business to the buyer.

The seller will want to restructure the target business in a manner that minimises disruption to its existing business and is as tax efficient as possible. The buyer will want to understand the restructuring steps and the accounting, tax, legal and commercial aspects of what they are acquiring.

In particular, it will be crucial for the buyer to understand any tax reliefs claimed by the seller and to consider whether any post completion integration to be undertaken by them could trigger a claw back of these reliefs.

This article is a buyer's guide to pre-sale restructuring.

What taxes does a buyer need to consider?

An informed buyer should ensure that the following tax heads are on their radar:

- Corporation tax on chargeable gains where a company transfers assets, businesses or shares.

- Capital gains tax for shareholders where shares are sold or exchanged.

- Capital gains withholding tax/CGT clearance where certain assets are transferred.

- Stamp duty where assets, businesses or shares are acquired, outright or by way of an exchange.

- Corporation tax where capital allowances are clawed back in respect of certain assets.

- VAT on the transfer of assets.

- Payroll tax considerations where employees are transferred.

What are the key questions a buyer should ask?

Where a pre-sale restructuring is the focal point of a tax due diligence, a buyer will need answers to the following key questions:

Q: What type of pre-sale restructuring was undertaken?

The most common types of pre-sale restructuring transactions which take place include:

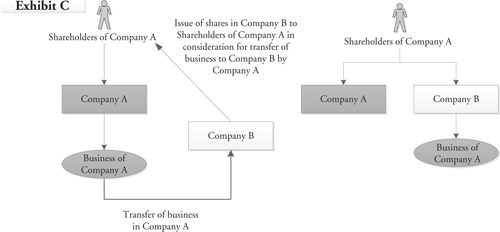

Share for share exchange

The shareholders of Company A exchange their shareholding in Company A for shares in another company, Company B. This results in Company A being directly owned by Company B (See Appendix, Exhibit A).

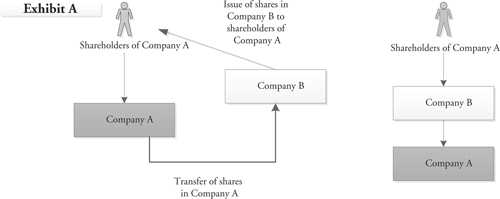

A two party share for undertaking transaction (‘two party swap’)

Company A transfers all or part of its business to Company B, set up outside the Group, in exchange for the issue of shares by Company B to Company A (See Appendix, Exhibit B).

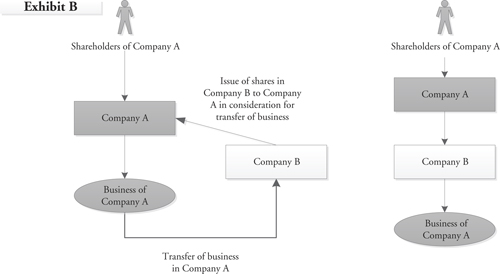

A three party share for undertaking transaction (‘three party swap’)

Company A transfers all or part of its business to Company B, set up outside the Group, in exchange for the issue of shares by Company B to the shareholders of Company A (See Appendix, Exhibit C).

These structures can facilitate the consolidation of the target or the creation of a ‘new’ target depending on the deal circumstances.

Q: What tax reliefs were availed of?

Provided certain conditions are met, the above types of pre-sale restructuring can be executed tax efficiently for Company A, the shareholders of Company A and Company B with no taxable gains arising on the transactions. However, the reliefs underpinning the tax efficiencies can be clawed back in the future in certain circumstances.

In addition, trading losses may also transfer to Company B as part of the transfer of the business under the two- party/three- party swap. It may also be possible to transfer assets to Company B at their tax written down value so that no balancing adjustment is triggered in the hands of Company A.

Q: Are there non-tax reasons for the restructuring?

Typically capital gains tax and stamp duty reliefs require that the reorganisation is carried out for bona fide commercial reasons. The reorganisation should not be undertaken solely with a view to achieving a tax advantage or tax deferral.

A key practical implication of this is contained in Revenue Tax Briefing 48 which stipulates that in order to qualify for tax reliefs a share for undertaking transaction must not be contingent on a future sale nor can a binding sale contract be in place.

A reorganisation, which is undertaken solely for tax reasons, should not be accepted by a buyer. The implications of a Revenue challenge based on anti-avoidance or “deliberate behaviour” in the context of a Revenue Audit can give rise to damage far in excess of the ultimate settlement - reputational risk, damage to relations with Revenue, in addition to loss of customer goodwill by virtue of association will be matters of extreme concern to the buyer of a business.

Q: Have all relevant claw backs of tax reliefs been considered?

Once a buyer has established which tax reliefs were claimed, it is then necessary to consider what circumstances could trigger a claw back of relief. The items below should be considered by a buyer depending on the nature of the pre-sale restructuring:

Capital Gains Tax

- Will there be a disposal of shares in Company B following a reconstruction/amalgamation (e.g. a share for share exchange)?

If yes, is further relief available to shelter any gain arising on a clawback of the previous relief? - Will there be a disposal of shares in Company B in a 6 year period following a two party swap leading to a reduction in Company A's base cost in the shares in Company B?

- If Company B leaves the capital gains tax group, is it secondarily liable where the seller defaults? What is the tax basis of the shares/assets transferred as part of the pre-sale restructuring?

- Are there material latent gains within the acquired company/group?

Stamp Duty

- Has stamp duty relief been claimed based on false information?

- Will the business of Company B transferred as part of the three party swap be disposed of?

- Will it be disposed of within 2 years on the pre-sale restructuring?

- Will 2 companies ceased to be associated so that an acquired company is jointly accountable?

Corporation Tax

- Have losses transferred such that the relevant trade must be preserved for at least 3 years?

Q: Did the capital gains withholding tax provisions apply to the restructuring?

Broadly speaking, in the absence of CGT clearance, capital gains withholding tax at 15% should be operated on the transfer of certain assets (land and buildings in the state, minerals or exploration / exploitation rights within the Irish continental shelf, shares deriving the greater part of their value from land or mineral rights and goodwill of a trade), where the consideration for the sale/transfer exceeds €500K. However, where the seller obtains a CG50 clearance certificate from Revenue, there should be no obligation to operate the withholding tax.

This provision applies equally in a group context and therefore, where any pre-sale restructuring has been undertaken, sight of all relevant documentation from capital gains withholding tax perspective should be sought by the buyer as this is an area that may be overlooked in the context of a corporate reorganisation.

Q: How was payroll managed on the restructuring?

On the transfer of employees, there may be payroll tax considerations for both the transferring and acquiring company. By Revenue concession, employees may be transferred from one company to another company without the requirement for the transferring company to issue Forms P45. Advance clearance is required from Revenue in order to avail of this concession.

Q: Have all legal, accounting and company law issues been considered and documented?

When undertaking a pre-sale restructuring, a range of legal, accounting and company law issues require consideration, in particular, the level of distributable reserves required in order to execute the proposed pre-sale restructuring. The buyer should request sight of all relevant documentation in order to understand what was executed legally.

An informed buyer

A pre-sale restructuring can add a layer of complexity to any tax due diligence review and due care is required.

Post-acquisition, there are a number of issues that can arise for a buyer where they attempt to integrate the newly-acquired business into their group structure. Care needs to be taken such that they do not inadvertently trigger tax by unwinding the structure implemented by the seller prior to sale.

From a legal perspective, steps taken to unwind the structure could be argued to be within the indemnity exclusion governing voluntary acts such that the buyer may have no recourse to the seller under the Tax Indemnity where a tax liability has crystallised in such circumstances.

To mitigate this risk, an informed buyer is critical. The buyer must have a detailed understanding of what was undertaken by the seller prior to the sale so that all relevant claw backs are understood and any post completion integration is carefully managed.

Let the buyer beware!

John Murphy is a corporate tax director working in PwC's Tax M&A Group.

Email: john.x.murphy@ie.pwc.com

Tele: + 353 1 792 6439

Rebecca Greene is a corporate tax manager, working in PwC's Tax M&A Group.

Email: rebecca.greene@ie.pwc.com

Tele: + 353 1 792 5059

Appendix

A two party share for undertaking transaction (‘two party swap’)

A three party share for undertaking transaction (‘three party swap’)