UK Tax reliefs for the creative industries

The UK film tax relief has provided over £1 billion of support to more than 1,000 films since its introduction in 2007 and has been heralded as a great success by government and the film industry alike. Building on this success, the UK government extended the relief to animated television productions and high-end drama and documentaries from 1 April 2013 and to video games from 1 April 2014. In addition, the government is now consulting on the introduction of a relief for the theatre industry from 1 September 2014.

Each of the regimes is structured in a similar way, but with slightly different conditions and definitions of qualifying expenditure to reflect the nature of each sector. For each relief, eligible companies receive an additional tax deduction for qualifying expenditure, which the company can either offset against taxable profits or surrender to the UK tax authorities in exchange for a cash tax credit worth up to 25% of the qualifying expenditure.

The aim of the reliefs – to support a sustainable creative industry with a world class skills and talent base in the UK – is welcome. The rate of relief compares favourably to similar reliefs in other countries and we are already seeing evidence that the reliefs are increasing the UK's competitiveness, encouraging additional investment in the UK and discouraging UK companies from moving activities to countries that already offer incentives. TIGA, the videogame industry trade association, estimates that the video games tax relief could enable UK video games developers and digital publishers to secure over 4,660 direct and indirect highly skilled jobs, and increase the game development sector's contribution to UK GDP by £283m over the next five years.

Who can Claim Relief?

The tax relief is given directly to the film, television or theatre production company or video games development company. This is a company which:

- is responsible for pre-production, principal photography, post-production and delivery of films and TV programmes or designing, producing and testing video games;

- is actively engaged in planning and decision-making during the production or development process; and

- directly negotiates, contracts and pays for rights, good and services.

Similar conditions are expected for theatre production companies.

The legislation also includes rules to determine which company can claim relief where more than one company meets the definition of a production or development company.

The Cultural Tests

With the exception of the proposed theatre tax relief, companies must meet certain British / EEA cultural tests before they can claim relief. The certification process for the cultural tests is administered by the British Film Institute.

A production or video game must gain at least 16 points out of a maximum of 31 across a range of cultural attributes to qualify as British. For example, points will be awarded for:

- British or EEA locations;

- British or EEA characters;

- a storyline of British or EEA origin;

- English or UK regional and minority language dialogue;

- Contribution to the promotion, development and enhancement of British culture;

- development activity taking place in the UK (or EEA in some cases); and

- use of British/EEA cast and crew or developers.

The tests for animation and video games reflect the fact that many cartoons and games are not set in the real world by also awarding points for lead characters of a nationality that cannot be determined and worlds or locations that cannot be determined.

Films and television productions can also qualify for relief under one of the UK's international co-production treaties.

What is the Relief Worth?

The calculation is slightly different for large budget (>£20 million) films, but for the other reliefs, the additional tax deduction is equal to the lower of:

- The UK element of the total core expenditure; and

- 80% of the total core expenditure.

The additional tax deduction can be offset against other taxable profits of the company, or potentially surrendered to other group companies, providing a tax saving at the relevant UK corporation tax rate (21% from 1 April 2014 to 31 March 2015 and 20% from 1 April 2015).

If the company makes a loss on the production or video game, it can surrender it to HMRC in exchange for a cash tax credit worth up to 25% of the amount surrendered (see later for rates for each relief). The amount that can be surrendered is restricted to the lower of:

- The additional tax deduction, as defined above; and

- The company's loss on the video game for the current period plus unused losses from previous periods.

As a result of the reduction in UK corporation tax rates in recent years, companies will receive a greater benefit where they are able to surrender losses for a cash tax credit rather than offset them against profits. Broadly, depending on the percentage of UK to overseas expenditure, where the headline rate of credit is 25%, the cash tax credit will be worth between 20% and 25% of qualifying UK expenditure.

Experience suggests that the majority of claimants structure their operations so that they can claim the cash tax credit in order to obtain the benefit of the relief as quickly as possible. In our experience to date, processing of claims by HMRC has also been very efficient, with payments received in around 6 weeks on average.

Film Tax Relief

The film tax relief applies to films that are certified as a British film, are intended for theatrical release at the cinema and have a minimum UK spend of 10%.

The relief applies to core production expenditure, which includes pre-production, principal photography and post-production expenditure and excludes speculative expenditure, marketing and financing costs.

The payable tax credit is given at a rate of 25% for the first £20 million of qualifying expenditure and a rate of 20% for all other expenditure. Broadly, depending on the percentage of UK to overseas expenditure, the repayment will be worth between 20% and 25% of qualifying UK expenditure for films with a budget of up to £20 million and slightly less for larger budget films.

Television Tax Relief

The television tax relief applies to animation, drama and documentaries that are certified as British television programmes, are intended for broadcast to the general public and have a minimum UK spend of 25%. The relief does not apply to advertising, news, current affairs, game shows, chat shows, variety shows, competitions and live events. Additionally, for drama and documentaries, the programme must have a slot length of more than 30 minutes and core production expenditure of at least £1 million per hour of slot length.

As for films, the relief applies to core production expenditure, which includes pre-production, principal photography and post-production expenditure and excludes speculative expenditure, marketing and financing costs.

The payable tax credit is given at a rate of 25% for all qualifying UK expenditure. Broadly, depending on the percentage of UK to overseas expenditure, the repayment will again be worth between 20% and 25% of qualifying UK expenditure.

Video Games Tax Relief

The video games tax relief applies to games that are certified as a British video game, are intended for supply to the general public and have a minimum EEA spend of 25%. The relief does not apply to games that are produced for advertising or promotional purposes, or for the purpose of gambling.

The relief applies to core development expenditure, which includes expenditure on designing, producing and testing a video game and excludes speculative expenditure, marketing, financing costs, debugging a completed video game and carrying out any maintenance in connection with a completed video game.

The payable tax credit is given at a rate of 25% for all qualifying UK expenditure. Broadly, depending on the percentage of UK to overseas expenditure, the repayment will be worth between 20% and 25% of qualifying UK expenditure.

Theatre Tax Relief

The proposed theatre tax relief is expected to apply to plays, musicals, opera, ballet and dance. Productions with a competition element, sexual entertainment and productions intended for broadcast will not qualify for relief. Productions will not need to meet cultural tests to qualify for theatre tax relief, but a minimum EEA spend of 25% will be required. It is proposed that the relief will apply to the charitable as well as commercial theatre sector, but some changes to the industry's current business models may be required in order to claim the relief.

The relief is expected to apply to initial development expenditure and production expenditure such as script development, casting, rehearsals, set design, costumes and visual and sound effects. The costs of “striking” the sets at the end of a production run will also qualify. Under the current proposals, running costs such as cast and crew, theatre rent, maintenance and moving costs will not qualify for relief, with the exception of substantive recasting and substantive changes to sets. Similarly to the other reliefs, marketing and financing costs will not qualify.

It is proposed that the payable tax credit will be given at a rate of 25% for touring productions and a rate of 20% for all other productions. The definition of touring productions is being considered as part of the consultation process. Broadly, depending on the percentage of UK to overseas expenditure, the repayment will be worth between 20% and 25% of qualifying UK expenditure for touring productions and between 16% and 20% for all other productions.

Conclusion

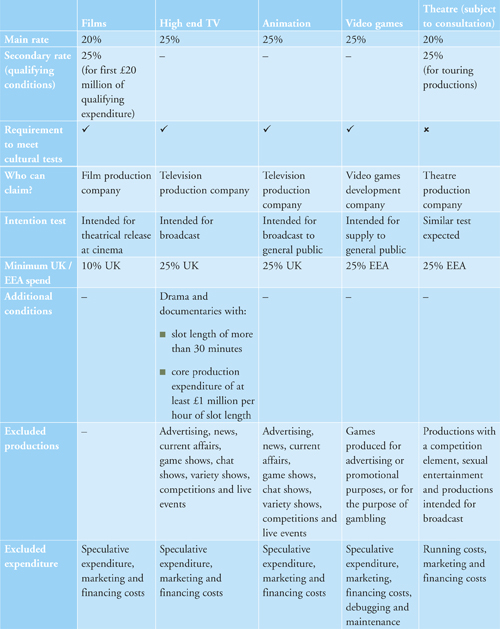

The following table summarises the key details and conditions in the creative industries tax reliefs:

Steven Stewart is a Tax Manager with Deloitte

Email: stestewart@deloitte.co.uk

Tel: +44 2890 531172